Parimatch has established itself as a global leader in the Indian online betting market thanks to its localized features and mobile-friendly interface. For mobile users, whether accessing the platform through the app or the mobile site, smooth payment processes play a critical role in enhancing the overall experience. Depositing funds quickly and withdrawing winnings effortlessly are essential aspects that keep bettors engaged and satisfied. Parimatch excels in this regard by offering a wide range of payment methods tailored to the Indian audience.

This article serves as a comprehensive guide to navigating Parimatch payments on mobile devices. We’ll explore everything you need to know about deposits, withdrawals, and the various payment methods available. Whether you prefer using UPI, Netbanking, credit or debit cards, e-wallets, or even cryptocurrency, this guide ensures you’ll have the information you need for a smooth transaction experience.

Additionally, we’ll provide detailed step-by-step instructions for making deposits and withdrawals, share tips for overcoming common challenges, and highlight the security measures Parimatch employs to protect user transactions. By the end of this article, you’ll have a clear understanding of how to manage payments efficiently on Parimatch’s mobile platform, ensuring a hassle-free and enjoyable betting experience. Let’s dive right into it!

Why Payment Methods Matter in Online Gaming

In the world of online gaming, particularly in betting and casino platforms like Parimatch, payment methods are a crucial aspect that directly impacts the user experience. They are not just about transferring funds between the player and the platform; they are the gateway to a seamless, secure, and efficient gaming journey. Understanding why payment methods matter can help players make informed decisions and enhance their overall experience.

Convenience and Accessibility

The ease with which players can deposit and withdraw funds is a major factor in determining the popularity of any online gaming platform. Players expect fast and simple payment processes, especially when accessing platforms on mobile devices. The range of payment methods offered, including UPI, e-wallets, credit/debit cards, and even cryptocurrency, ensures that users from different backgrounds and preferences can easily access the platform. The ability to choose a payment method that suits personal preferences—whether it’s a digital wallet or a traditional bank transfer—ensures convenience and boosts user satisfaction.

Speed of Transactions

In the fast-paced world of online gaming, speed is everything. Players want to deposit funds quickly to place their bets and withdraw their winnings without unnecessary delays. Payment methods like UPI, Paytm, and e-wallets often offer near-instantaneous deposits and withdrawals, ensuring players can access their money when they need it most. A slow withdrawal process can be frustrating, especially when players want to cash out their winnings immediately after a successful game. Fast and reliable payment options are, therefore, essential for keeping users engaged and satisfied.

Security and Trustworthiness

Security is paramount when it comes to handling real money in online gaming. Payment methods should be secure, protecting users’ sensitive financial data from cyber threats. Platforms that offer secure payment gateways, such as SSL encryption and two-factor authentication (2FA), provide users with the confidence that their transactions are safe. Trusted payment methods like bank transfers and well-established e-wallets add an extra layer of credibility and security, fostering trust between the user and the platform.

Regional Relevance

Payment methods also matter in online gambling because they cater to the specific needs of regional users. For Indian players, UPI-based payments and local e-wallets like Paytm are more relevant than international payment systems. When platforms provide region-specific payment options, they create a localized experience that makes it easier for users to engage with the platform, ensuring a larger customer base and improved retention.

Regulatory Compliance

Online betting and casino platforms are also responsible for making sure their payment methods comply with local financial regulations and anti-money laundering (AML) rules. This not only ensures legal operations but also protects players from fraud. Players can feel secure knowing that platforms with compliant payment methods operate within the law, safeguarding their funds.

In conclusion, payment methods are not just a behind-the-scenes element of online gaming; they are an essential part of the user experience. The right combination of convenience, speed, security, and regional relevance sets a platform apart from its competitors and drives player loyalty.

Overview of Parimatch Mobile Platform for Payments

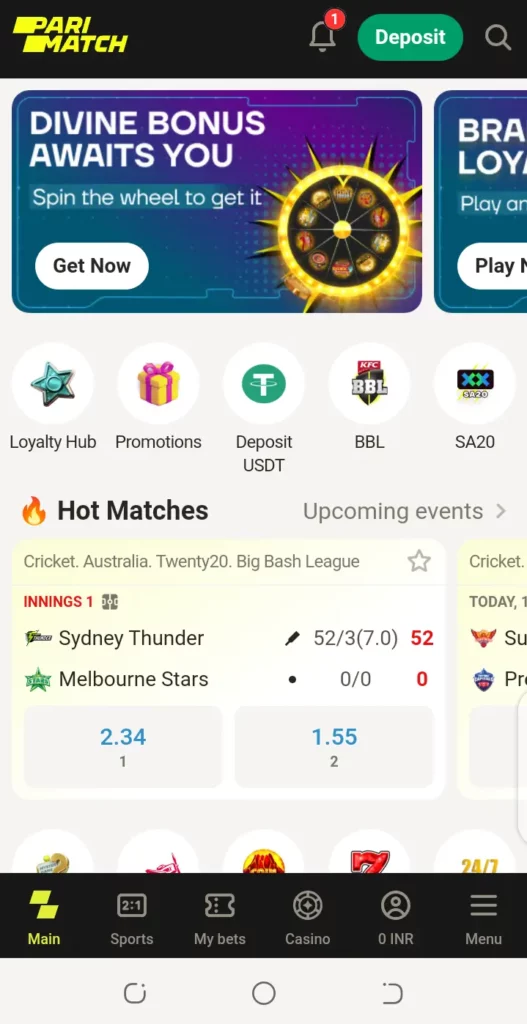

Parimatch has earned a reputation as one of the top betting platforms globally, and its mobile version is designed to provide seamless access for users in India. With a focus on user experience, convenience, and secure transactions, the Parimatch mobile site and app are optimized to cater specifically to the needs of mobile users.

Mobile Site vs. Mobile App

Parimatch offers both a responsive mobile site and a dedicated mobile app, ensuring that users have flexibility depending on their preferences. The mobile site is designed to offer a smooth and intuitive experience for users who prefer to access the platform through their browsers. It adapts to various screen sizes, offering the same functionalities as the desktop version, from placing bets to making payments. The mobile app, available for Android devices, can be downloaded directly from the Parimatch website or app stores, providing a more customized and performance-enhanced experience.

Key Features and User Interface

The Parimatch mobile platform is known for its simple yet functional user interface. Navigating the site or app is effortless, with clear sections dedicated to sports betting, live casino games, promotions, and payment methods. Users can access all their betting needs with a few taps, whether it’s placing bets on cricket or football or exploring the wide range of online casino games available.

The mobile platform is designed to prioritize speed and efficiency. With fast load times and minimal latency, users can enjoy real-time betting and smooth navigation, even during live events. The app and mobile site are also optimized for seamless deposits and withdrawals, ensuring that users can manage their funds securely and quickly.

Payment Integration on Mobile

One of the standout features of the Parimatch mobile platform is its integrated payment system. Indian users can deposit and withdraw funds easily via local payment methods such as UPI (PhonePe, Google Pay, Paytm), Netbanking, and e-wallets (Skrill, Neteller). The mobile site and app both feature a clear and straightforward process for users to complete transactions smoothly, ensuring a hassle-free experience.

Security and Customer Support

Parimatch takes user security seriously. Both the mobile site and app are encrypted with SSL technology to protect users’ sensitive data. Furthermore, Parimatch offers 24/7 customer support via live chat and email to users experiencing issues with payments or account management. This ensures that users’ concerns are addressed promptly, further enhancing the mobile experience.

Payment Methods on Parimatch

Parimatch provides a comprehensive selection of payment options tailored to the needs of Indian users, ensuring that deposits and withdrawals are straightforward, secure, and convenient. This section will explore the deposit and withdrawal methods in detail, covering the minimum and maximum transaction limits, processing times, and unique advantages of each payment type.

Deposit Methods

Parimatch offers diverse deposit methods, allowing users to choose based on convenience, speed, or preferred platforms. The following deposit options are available for Indian users:

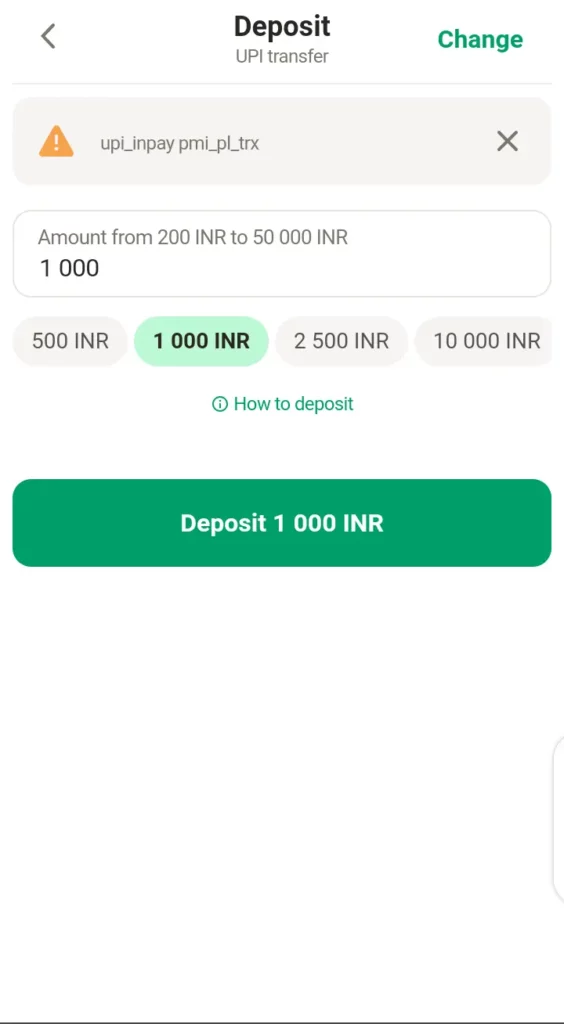

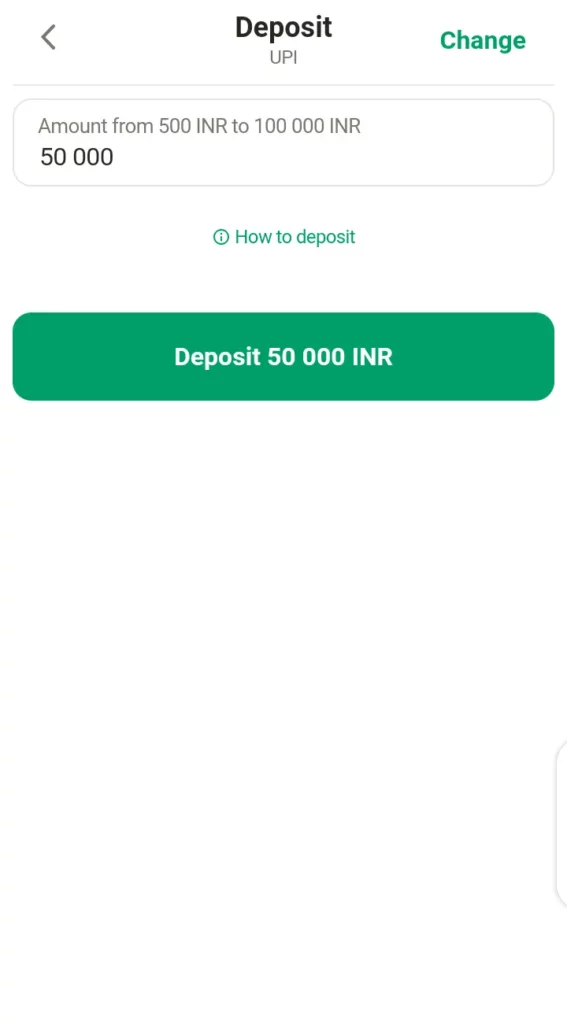

UPI Transfer

- Min Deposit: ₹200

- Max Deposit: ₹50,000

- Processing Time: 10 minutes to 5 hours

UPI (Unified Payments Interface) is one of the most popular deposit methods for Indian users due to its integration with platforms like Google Pay, PhonePe, and Paytm. It offers high compatibility with mobile sites and apps, making it a go-to choice for instant and secure deposits.

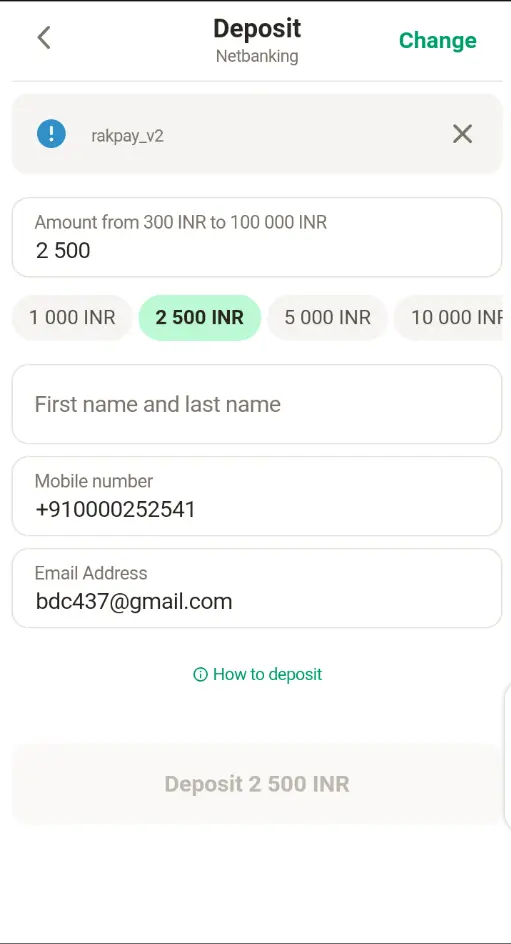

Netbanking

- Min Deposit: ₹300

- Max Deposit: ₹100,000

- Processing Time: 10 minutes to 5 hours

Netbanking caters to users who prefer traditional banking methods. While it may take slightly longer for funds to reflect in the Parimatch wallet, this method supports higher deposit limits, making it ideal for users who wish to deposit significant amounts.

Alt text: Netbanking deposit screen showing the amount, name, mobile, email fields, and a deposit option.

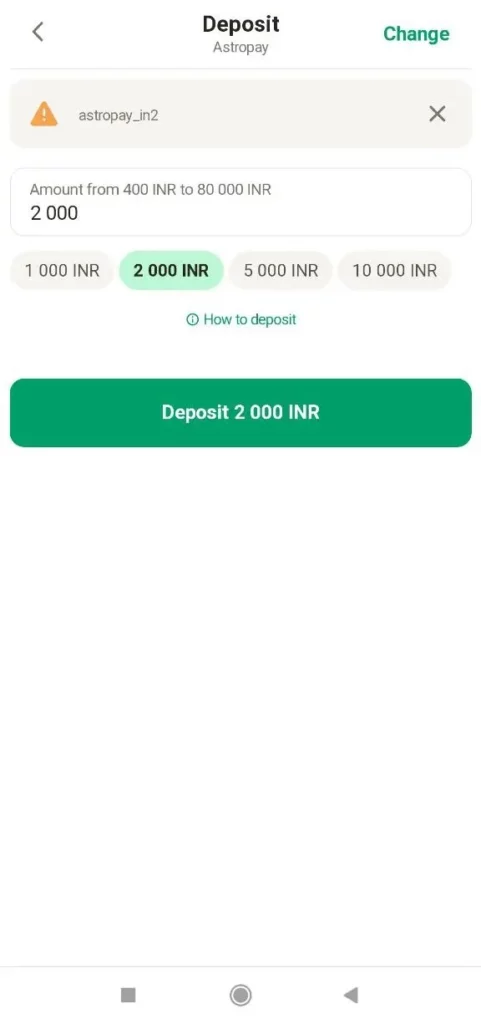

Astropay

- Min Deposit: ₹400

- Max Deposit: ₹80,000

- Processing Time: Instant

Astropay is a digital prepaid card service that allows users to make instant deposits. It provides an extra layer of anonymity and security since users can load the card with a specific amount before transferring funds.

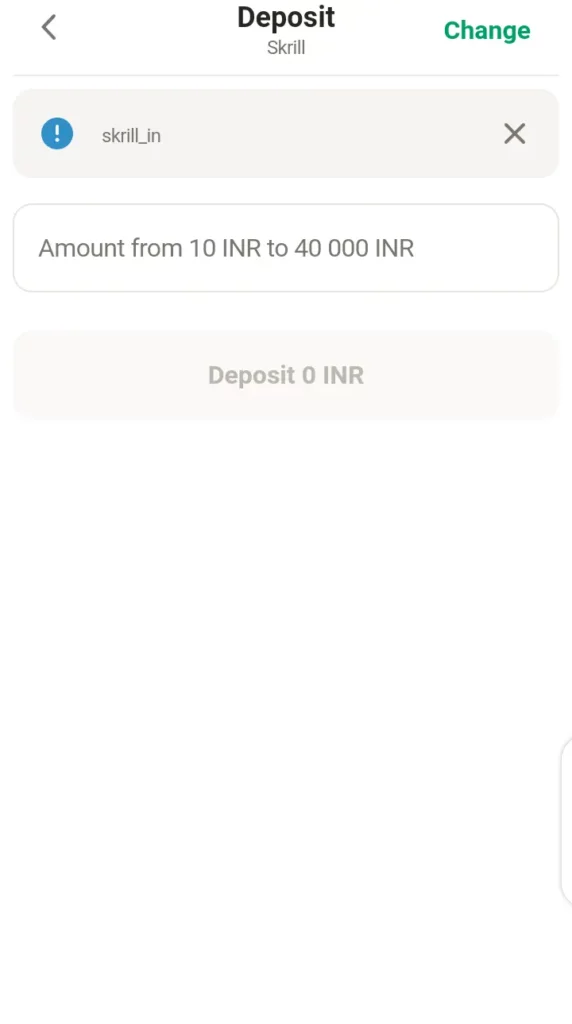

Skrill and Neteller

- Min Deposit: ₹10

- Max Deposit (Neteller): ₹40,000 (no upper limit for Skrill)

- Processing Time: Instant

Skrill and Neteller are widely recognized e-wallets known for their fast processing times and global reach. These platforms are particularly useful for users who engage in international betting or prefer e-wallets for privacy.

Cryptocurrency Options

Parimatch supports an array of cryptocurrencies, allowing tech-savvy users to make deposits in Bitcoin, Ethereum, Litecoin, Tether (TRC-20), Bitcoin Cash, and more. Here are some details:

- Bitcoin: Min Deposit: 0.0001 BTC, Processing Time: Instant

- Ethereum: Min Deposit: 0.01 ETH, Processing Time: Instant

- Tether (TRC-20): Min Deposit: 5 USDT, Processing Time: Instant

Cryptocurrencies are ideal for users looking for highly secure and borderless transactions. With no maximum deposit limits, they cater to high-stakes players.

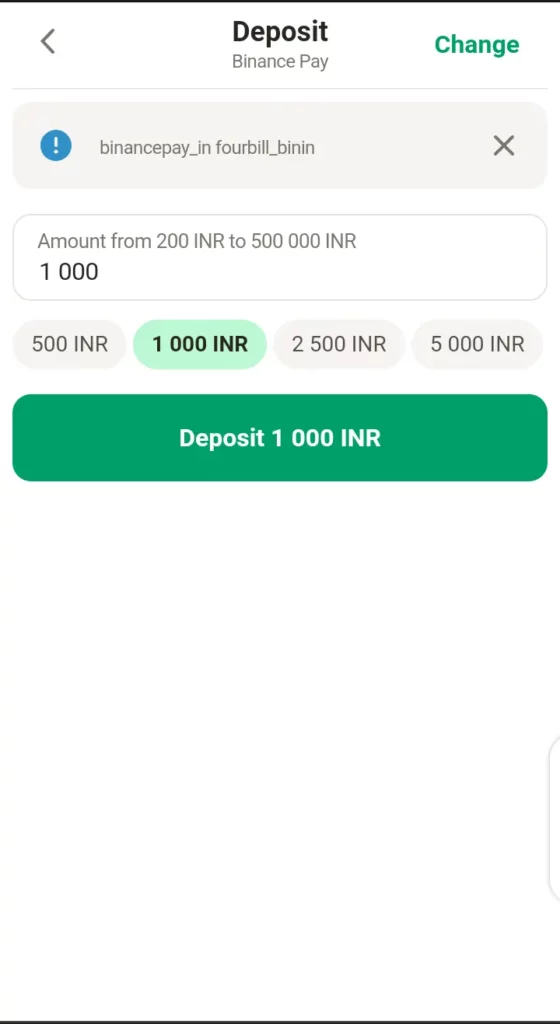

Binance Pay

- Min Deposit: ₹200

- Max Deposit: ₹500,000

- Processing Time: Instant

Binance Pay allows users to transfer funds directly from their Binance accounts. With high maximum deposit limits and near-instant processing, this method appeals to crypto traders and enthusiasts.

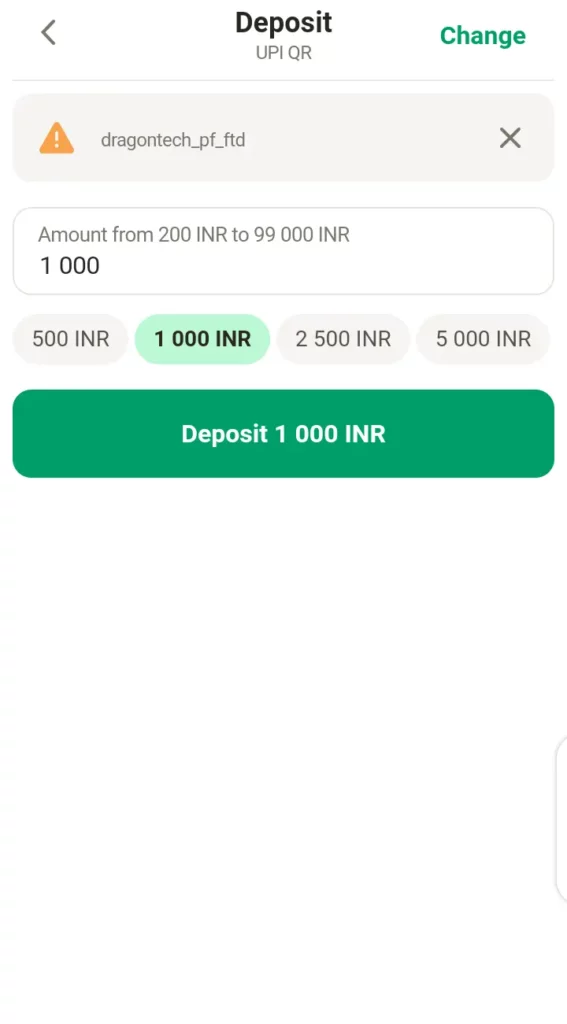

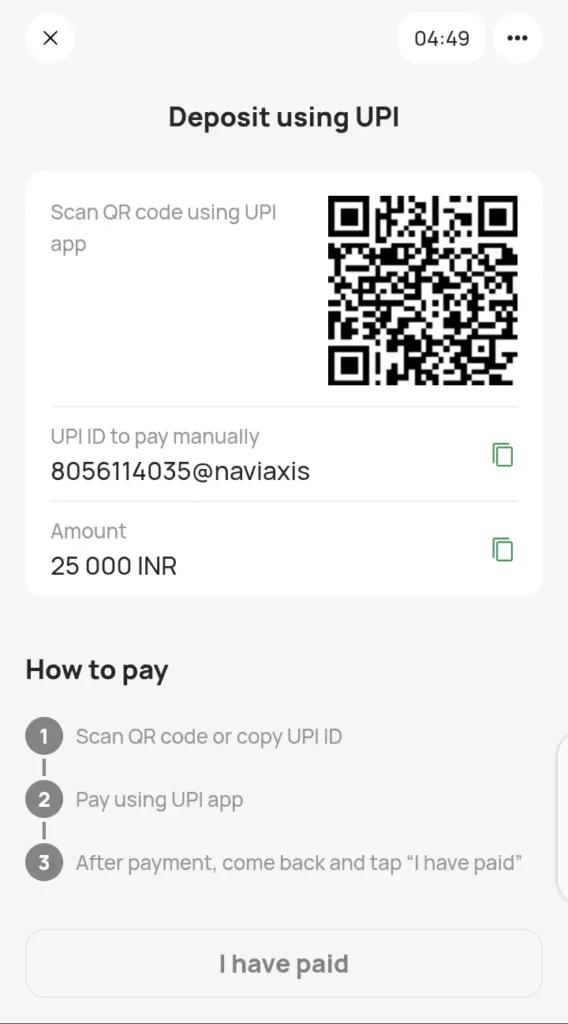

UPI QR and PhonePe Direct

- UPI QR: Min Deposit: ₹200, Max Deposit: ₹99,000

- PhonePe Direct: Min Deposit: ₹300, Max Deposit: ₹100,000

Both options offer secure, instant deposits through QR code scanning or direct transfers, making them highly user-friendly and suited for mobile-first users.

Deposit Table

Below is a detailed breakdown of the deposit methods available on the Parimatch

| Method Name | Min Deposit | Max Deposit | Processing Time |

| UPI Transfer | ₹200 | ₹50,000 | 10 min–5 hours |

| Netbanking | ₹1,000 | ₹200,000 | 10 min–5 hours |

| Astropay | ₹400 | ₹80,000 | Instantly |

| Skrill | ₹800 | – | Instantly |

| Neteller | ₹10 | ₹40,000 | Instantly |

| Bitcoin | 0.0001 BTC | – | Instantly |

| Tether TRC-20 | 5 USDT | – | Instantly |

| Litecoin | 0.033 LTC | – | Instantly |

| Ethereum | 0.01 ETH | – | Instantly |

| Bitcoin Cash | 0.01 BCH | – | Instantly |

| Binance Pay | ₹200 | ₹500,000 | Instantly |

| PhonePe Direct | ₹300 | ₹100,000 | Instantly |

| UPI QR | ₹200 | ₹99,000 | 10 min–5 hours |

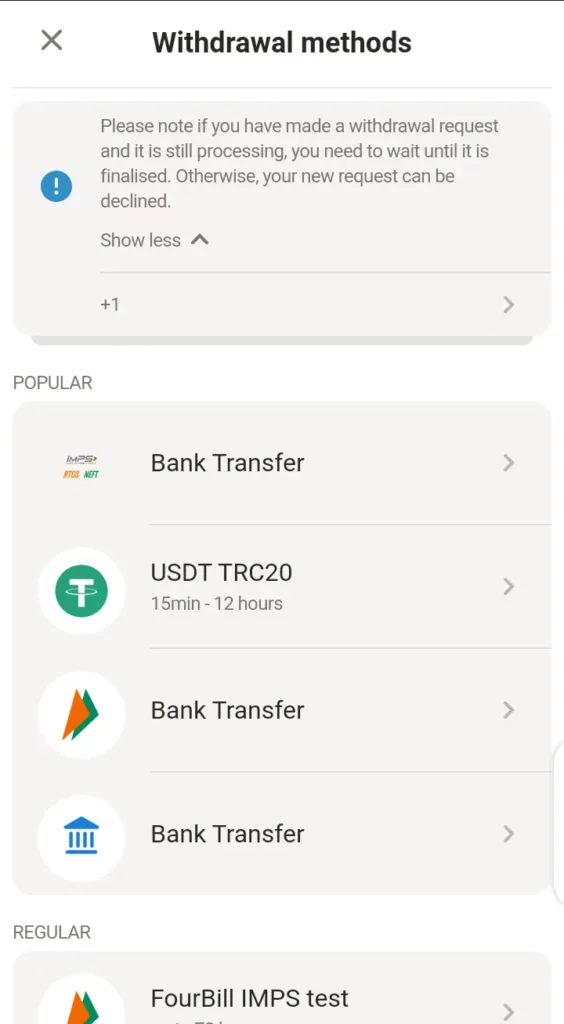

Withdrawal Methods

Parimatch simplifies withdrawing winnings by offering multiple secure options with transparent processing times and limits. The withdrawal options are outlined below:

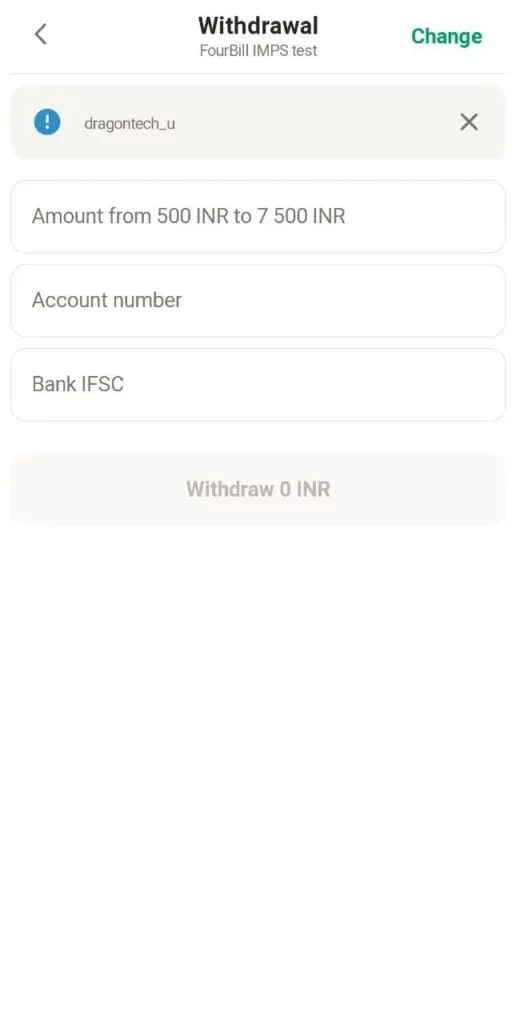

IMPS

- Min Withdrawal: ₹500

- Max Withdrawal: ₹7,500

- Processing Time: Up to 48 hours

IMPS (Immediate Payment Service) is a reliable option for users looking to transfer winnings directly to their bank accounts. While the processing time is slightly longer, Indian banks widely support the service.

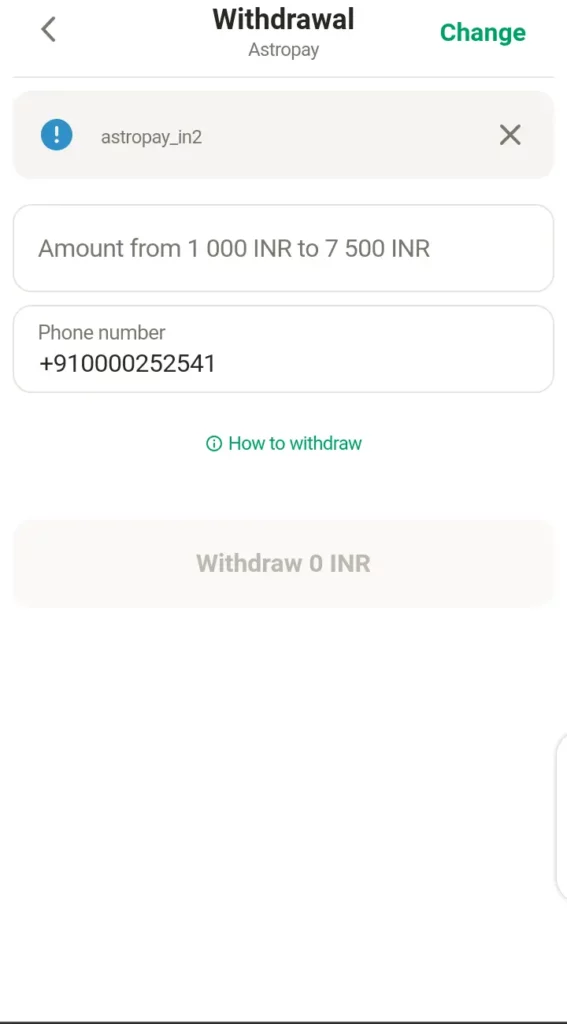

Astropay

- Min Withdrawal: ₹1,000

- Max Withdrawal: ₹7,500

- Processing Time: Up to 1 hour

Astropay ensures swift withdrawals for users who initially deposited using the same method. Its convenience and relatively quick processing make it a favored option among users.

Cryptocurrency Withdrawals

- Bitcoin: Min Withdrawal: ₹1,300, Max Withdrawal: ₹7,500, Processing Time: 15 minutes to 12 hours

- Ethereum: Min Withdrawal: ₹1,800, Max Withdrawal: ₹7,500, Processing Time: 15 minutes to 12 hours

- Tether (TRC-20): Min Withdrawal: ₹500, Max Withdrawal: ₹7,500, Processing Time: 15 minutes to 12 hours

For users well-versed in cryptocurrency, these methods offer unmatched security and quick turnaround times. They are particularly beneficial for those looking for borderless transactions with minimal fees.

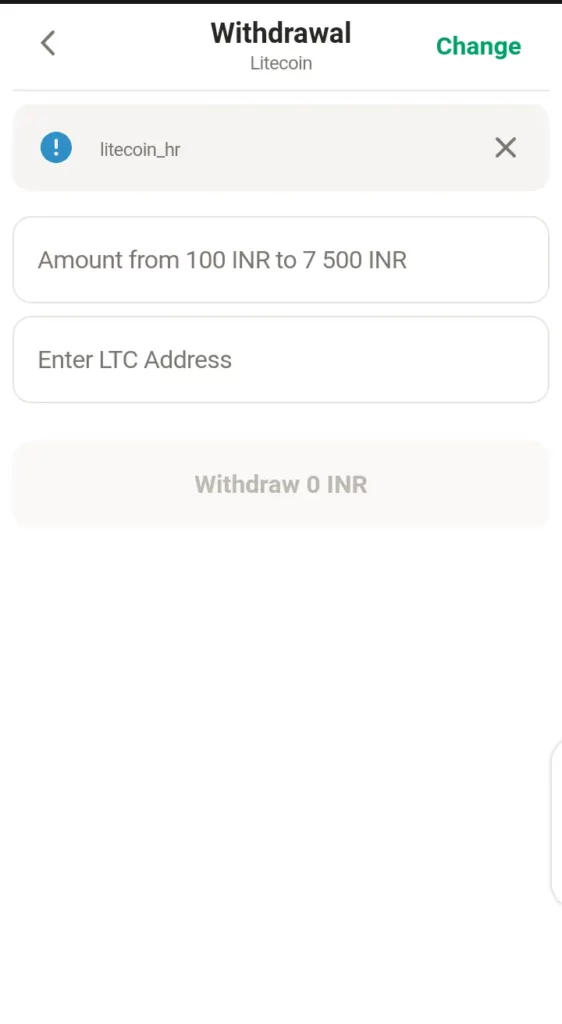

Litecoin and Bitcoin Cash

- Litecoin: Min Withdrawal: ₹100, Max Withdrawal: ₹7,500

- Bitcoin Cash: Min Withdrawal: ₹20, Max Withdrawal: ₹7,500

Both Litecoin and Bitcoin Cash provide withdrawal features similar to those of Bitcoin and Ethereum but are known for their lower transaction fees and faster processing times, making them a cost-effective choice.

Withdrawal Table

The table below offers an overview of the withdrawal methods available on Parimatch

| Method Name | Min Withdrawal | Max Withdrawal | Processing Time |

| IMPS | 500 | 7,500 | Up to 48 hours |

| Astropay | 1,000 | 7,500 | Up to 1 hour |

| Bitcoin | 1,300 | 7,500 | 15 minutes – 12 hours |

| Ethereum | 1,800 | 7,500 | 15 minutes – 12 hours |

| Bitcoin Cash | 20 | 7,500 | 15 minutes – 12 hours |

| Litecoin | 100 | 7,500 | 15 minutes – 12 hours |

| Tether TRC-20 | 500 | 7,500 | 15 minutes – 12 hours |

Comparison of Deposit and Withdrawal Methods

- Speed: Cryptocurrency and e-wallets like Skrill, Neteller, and Astropay lead in terms of speed, often processing deposits instantly and withdrawals within the hour. Traditional methods like Netbanking and IMPS can take longer.

- Limits: Cryptocurrency methods generally offer the most flexibility with higher maximum deposit limits. For withdrawals, limits are capped uniformly across most methods at ₹7,500 per transaction.

- Convenience: UPI and QR-based methods are highly convenient for Indian users, given their widespread adoption and compatibility with popular apps.

Choosing the Best Method

The choice of payment method depends on user preferences:

- For speed, cryptocurrencies and e-wallets are unmatched.

- For simplicity, UPI methods like PhonePe and QR code scanning are ideal.

- For higher limits, options like Binance Pay and Netbanking stand out.

Parimatch ensures that all payment methods are secure, with SSL encryption and compliance with anti-money laundering protocols. Users can choose the method that aligns with their comfort level and transaction needs. By offering a variety of payment options, the online casino and sportsbook enhances its appeal to a diverse user base, ensuring seamless financial transactions for Indian mobile users

How to Make Deposits on Parimatch Mobile

Depositing funds into your Parimatch account through the mobile site or app is straightforward, thanks to the platform’s user-friendly interface and variety of payment options tailored to Indian users. This section will guide you step-by-step through the process and provide valuable tips to ensure a smooth experience.

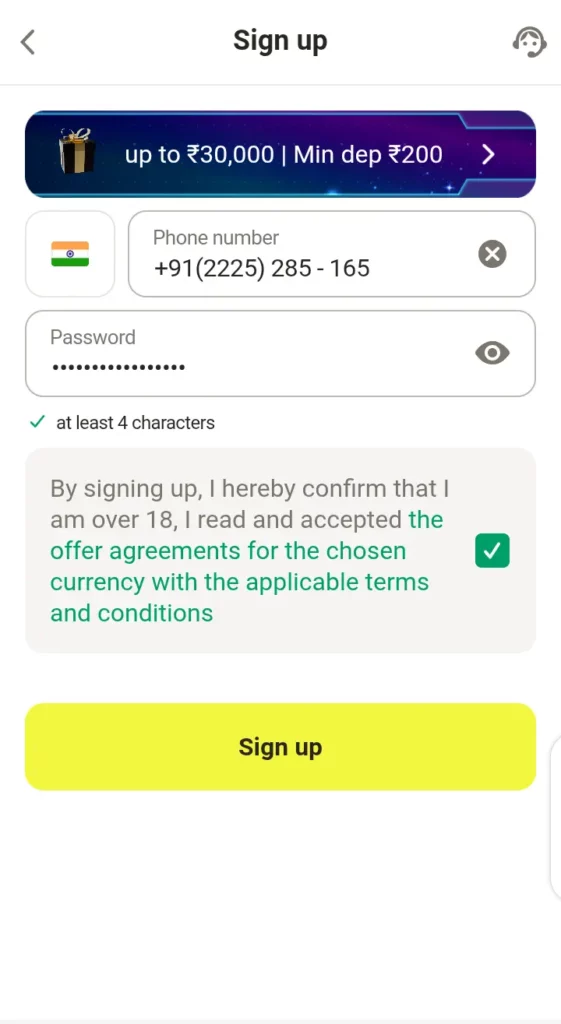

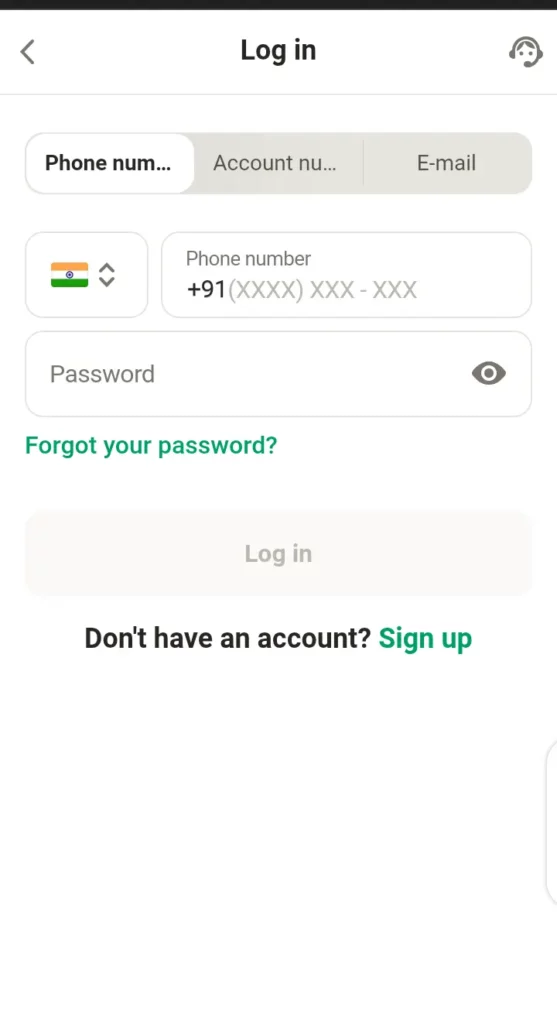

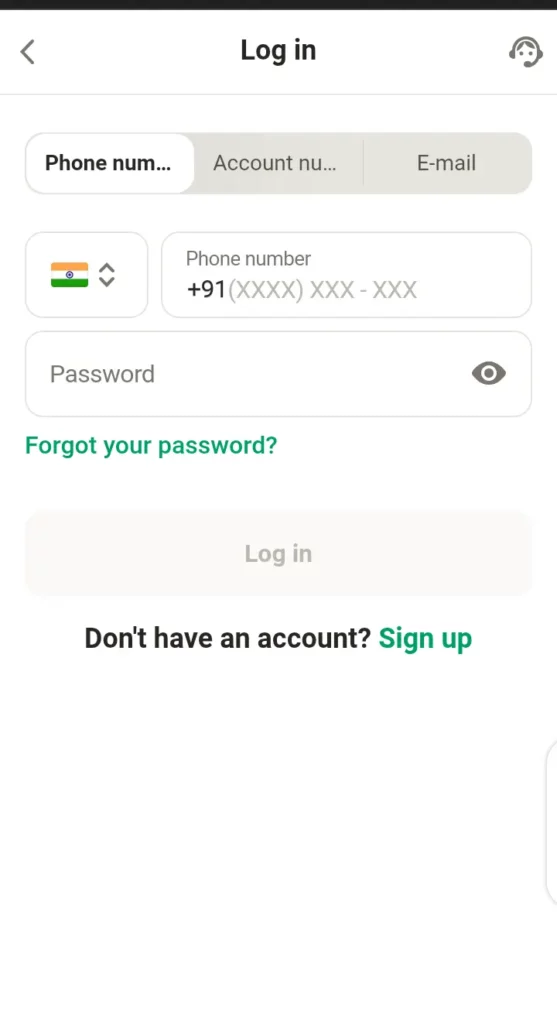

Step 1: Register or Log in to Your Parimatch Account

If you’re new to Parimatch, download the app from the official website or access the mobile site. Click on the “Sign Up” button and complete the registration process by entering your details, such as your name, phone number, email, and preferred currency (INR for Indian users).

After registration, log in using your registered email or phone number and password.

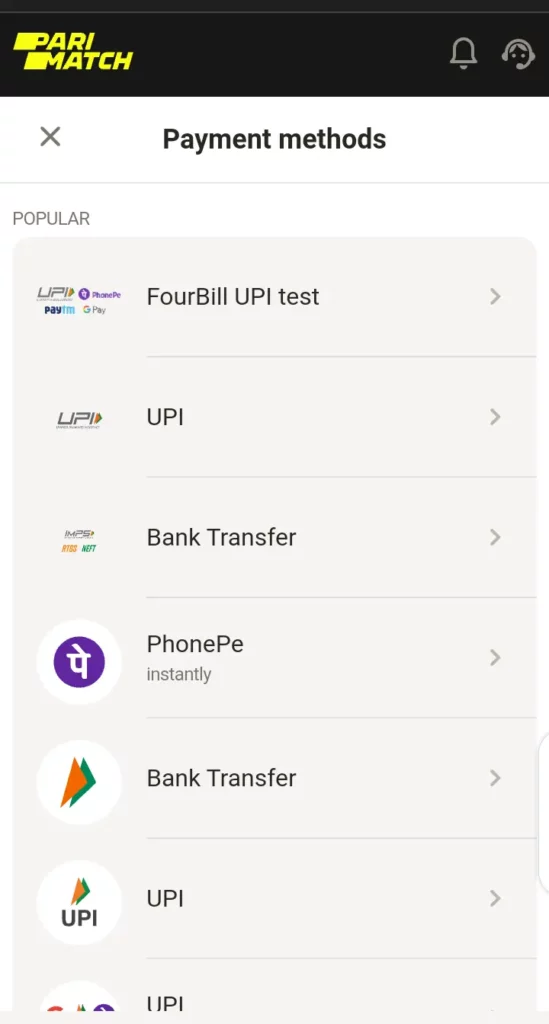

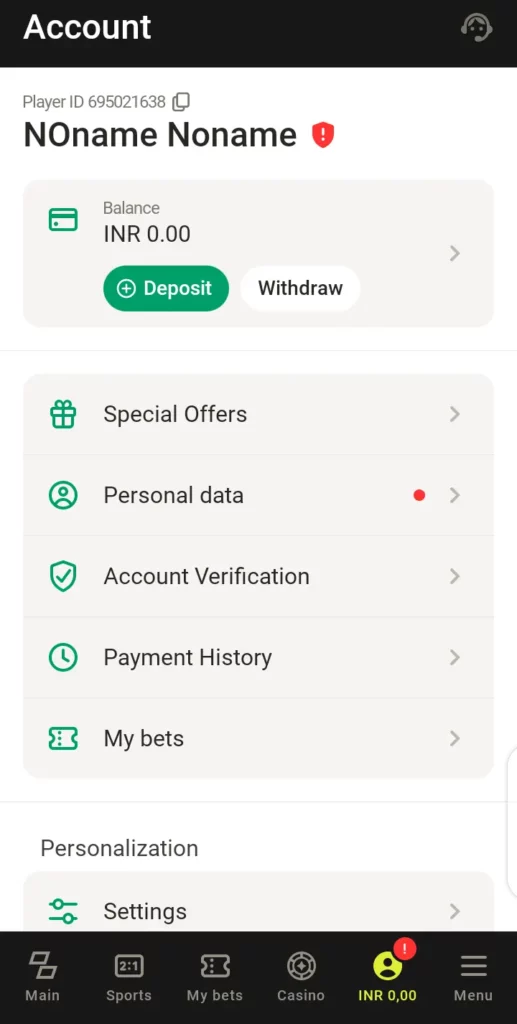

Step 2: Navigate to the Deposit Section

- Once logged in, locate the deposit button, typically found at the top of the screen on the app or mobile site.

- Tap the button to access the payment methods page.

Step 3: Choose a Payment Method

Parimatch offers a variety of deposit methods for Indian users, including:

- UPI-based apps like PhonePe, Google Pay, and Paytm.

- Netbanking for direct transactions from your bank account.

- Credit/Debit Cards from Visa, Mastercard, or RuPay.

- E-wallets such as Skrill and Neteller.

- Cryptocurrencies like Bitcoin and Ethereum.

Select your preferred method based on convenience and speed. For example, UPI is popular for its instant processing and ease of use.

Step 4: Enter the Deposit Amount

Input the amount you wish to deposit. Ensure the amount meets the minimum deposit requirement for the chosen payment method.

Step 5: Complete the Payment

- UPI Users: Enter your UPI ID and authorize the transaction through your payment app.

- Card Users: Provide your card details, such as number, expiration date, and CVV, and complete the 3D Secure verification.

- E-wallet/Crypto Users: Log into your wallet and confirm the payment.

Step 6: Confirm and Check Your Account Balance

After completing the transaction, return to the Parimatch mobile platform to verify that the funds have been credited to your account. Deposits are typically instant but may take up to 15 minutes in some cases.

Tips for Smooth Deposits

Making deposits can sometimes encounter minor hiccups. Here are tips to ensure a hassle-free experience:

1. Ensure Sufficient Balance and Payment Method Activation

- Before initiating a deposit, check that your bank account or wallet has enough funds to cover the transaction.

- Ensure that your UPI app or card is activated for online payments.

2. Verify Your Account Details

- Double-check the details you enter, such as UPI ID, card number, or wallet credentials, to avoid errors.

- Keep your registered phone number and email address updated, as some payment methods require OTPs (one-time passwords) for authorization.

3. Know the Limits

- Familiarize yourself with the minimum and maximum deposit limits for your chosen payment method.

- Avoid exceeding limits to prevent failed transactions or unnecessary delays.

4. Troubleshoot Common Issues

- Declined Transactions: If your deposit fails, check for potential issues like incorrect details, insufficient funds, or network connectivity problems.

- Processing Delays: While most deposits are instant, bank or payment gateway issues might cause delays. Wait for up to 30 minutes or contact Parimatch’s support for assistance.

5. Opt for the Fastest Methods

- For instant deposits, UPI and e-wallets are the fastest and most reliable options.

- Cryptocurrency can also be a great choice for those seeking enhanced privacy and faster processing. Cryptocurrency deposits may take longer due to blockchain confirmation times but are ideal for users prioritizing anonymity.

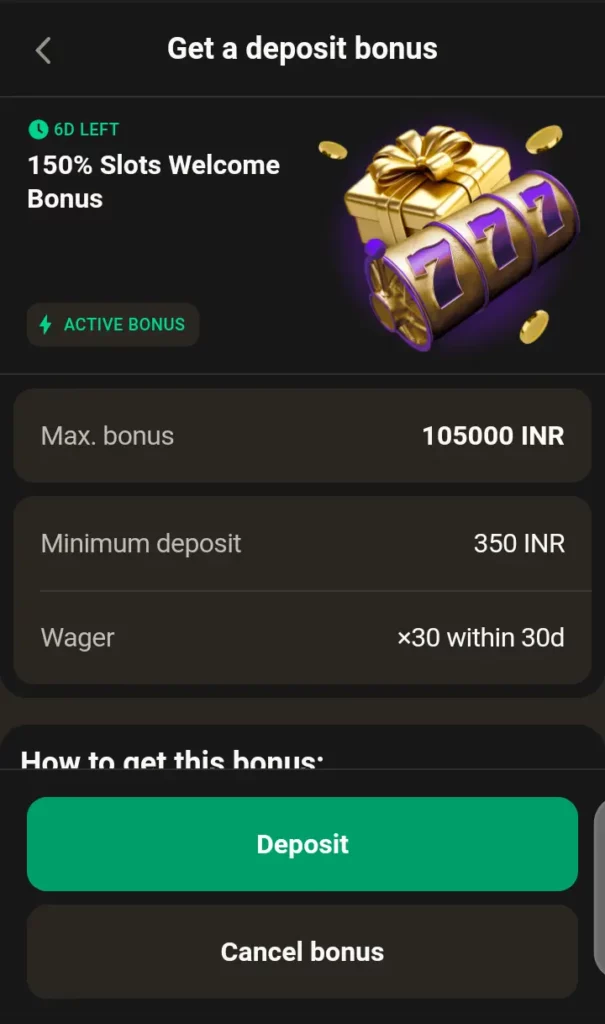

6. Utilize Promotions

- Check for deposit-related bonuses or promotions that Parimatch offers, especially for new users. Use bonus codes, if applicable, during the deposit process to maximize your funds.

7. Contact Support for Issues

- If your deposit doesn’t reflect immediately, reach out to Parimatch customer support through the live chat feature. Keep a screenshot of the transaction as proof.

How to Withdraw Funds from Parimatch Mobile

Efficient withdrawals are a key feature of Parimatch, ensuring users can access their winnings with ease. Here’s a comprehensive guide to withdrawing funds on the Parimatch mobile platform, along with essential tips for hassle-free transactions.

Step 1: Log in to Your Parimatch Account

- Open the Parimatch mobile app or visit the mobile-optimized site.

- Enter your username/email and password to log in.

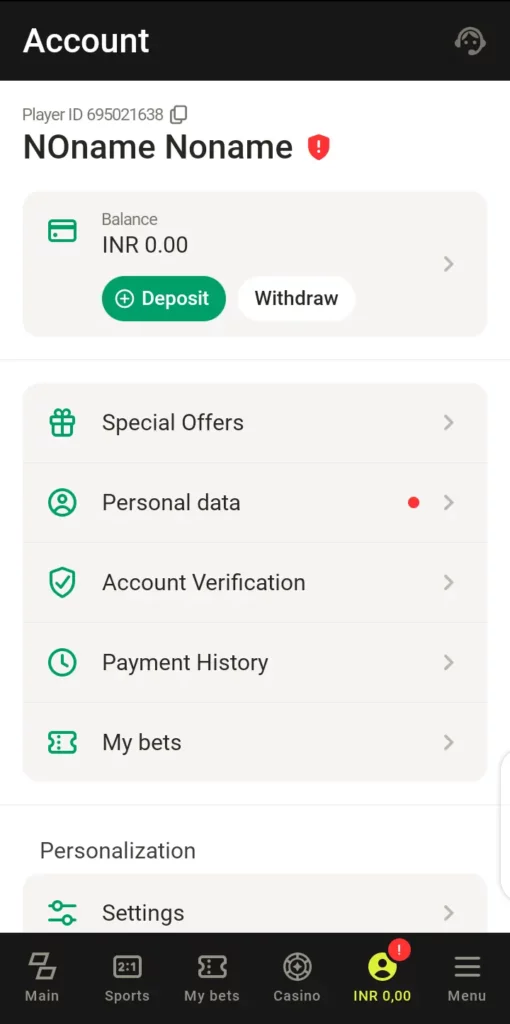

Step 2: Navigate to the Withdrawal Section

- Once logged in, tap on the “My Account” button displaying your balance (usually in the top-right corner).

- Click on the “Withdraw” option to access the withdrawal interface.

Step 3: Select a Withdrawal Method

Review the list of available withdrawal options for Indian users:

- UPI (PhonePe, Google Pay, Paytm)

- Netbanking

- E-wallets (Skrill, Neteller)

- Cryptocurrency (Bitcoin, Ethereum)

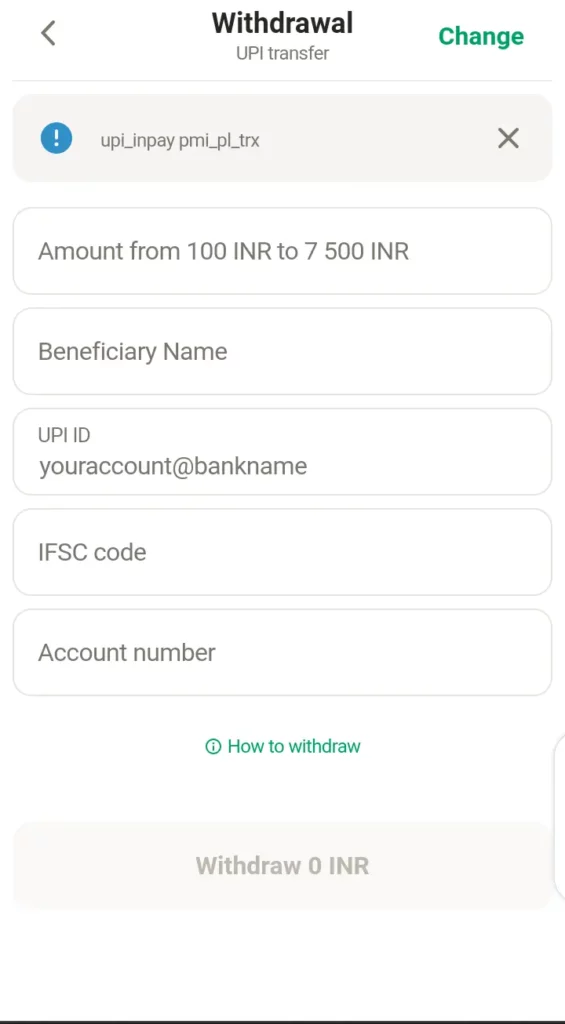

Step 4: Enter the Withdrawal Amount

- Check your account balance to confirm the amount you want to withdraw.

- Note the minimum and maximum withdrawal limits for your chosen method (e.g., ₹500 minimum for UPI).

- Enter the exact amount within the allowed range.

Step 5: Provide Necessary Details

Depending on the withdrawal method, provide the required information:

- For UPI: Enter your UPI ID (e.g., yourname@upi).

- For Netbanking: Provide your account number and IFSC code.

- For E-wallets: Input the registered email address linked to your wallet.

- For Cryptocurrency: Enter the wallet address carefully to avoid errors.

Step 6: Confirm the Withdrawal Request

- Double-check all the details, including the withdrawal amount and method.

- Tap “Confirm” to initiate the request.

- A confirmation screen will appear, showing the transaction ID and estimated processing time.

Step 7: Monitor the Withdrawal Status

- Visit the Transaction History section in your account to track the status of your withdrawal.

- The status will update to “Processing” and eventually to “Completed” once the funds are released.

Step 8: Receive Funds

Depending on the method chosen, you’ll receive the funds within the specified timeframe:

- UPI/Netbanking: 24-48 hours.

- E-wallets: Instant to 24 hours.

- Cryptocurrency: Within a few hours, depending on network congestion.

Tips for Hassle-Free Withdrawals

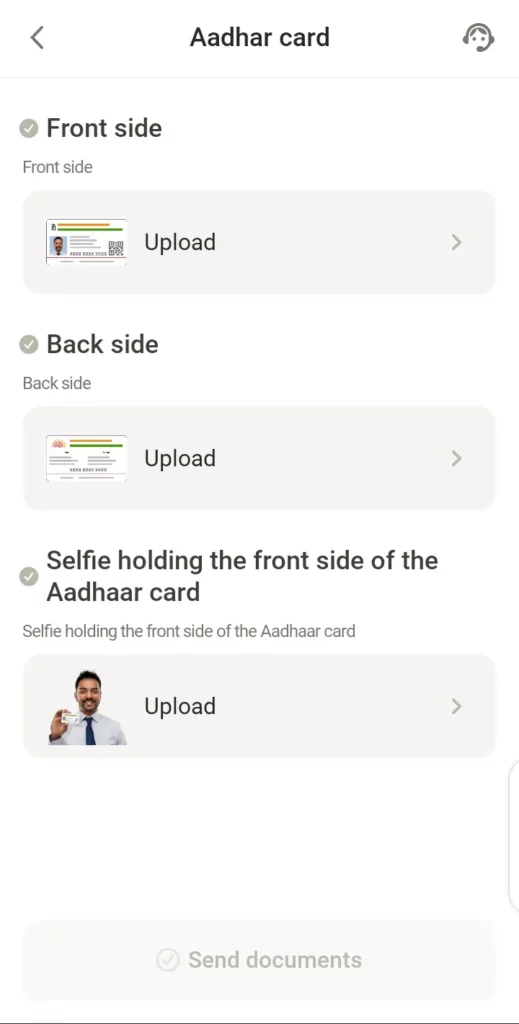

1. Verify Your Account

You need to complete your KYC verification to avoid delays. Upload required documents like an Aadhaar card, PAN card, or passport for identity verification. Ensure the name on your Parimatch account matches the details of your payment method.

2. Use the Same Deposit and Withdrawal Method

Parimatch encourages users to withdraw funds using the same method they used for deposits. This minimizes delays and ensures smoother processing.

3. Check for Pending Bonuses

If you’ve claimed any bonuses, make sure you’ve met the wagering requirements before attempting a withdrawal. Unfulfilled conditions may block withdrawal requests.

4. Be Aware of Withdrawal Limits

Stay within the minimum and maximum withdrawal limits for your selected method.

- UPI: ₹500 minimum, ₹1,00,000 maximum.

- E-wallets: ₹1,000 minimum, ₹5,00,000 maximum.

5. Monitor Withdrawal Times

Withdrawal processing times may vary based on the method:

- UPI and net banking typically take 1-2 working days.

- E-wallets and cryptocurrency withdrawals are faster.

6. Avoid Frequent Small Withdrawals

Consolidate smaller winnings into a larger amount to avoid unnecessary fees and delays. Frequent small withdrawals may also attract scrutiny from payment processors.

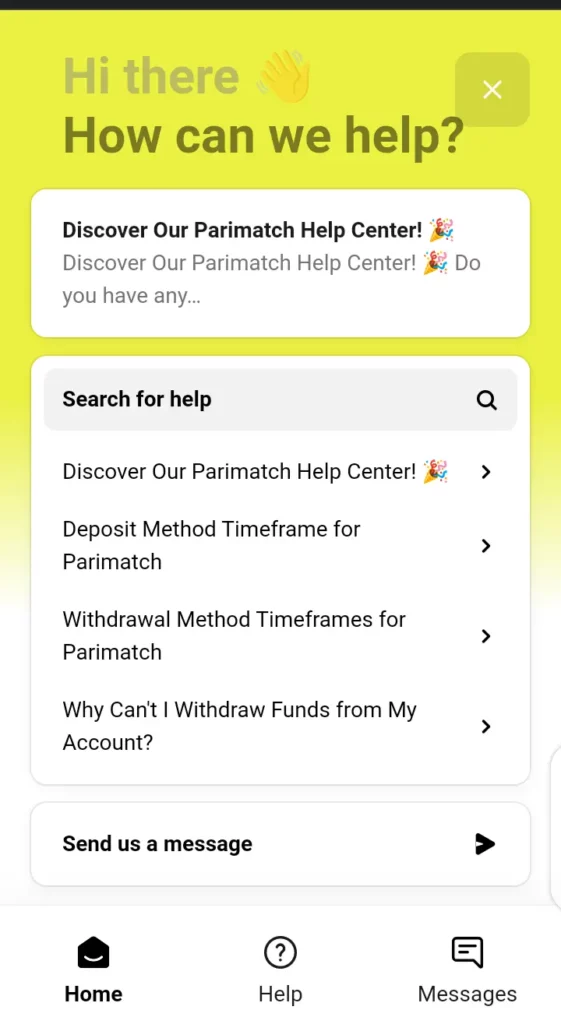

7. Contact Support if Necessary

If your withdrawal is delayed beyond the expected time, contact Parimatch customer support via:

- Live chat (available 24/7).

- Email support at [email protected].

Keep your transaction ID handy for quicker resolution.

8. Double-Check Details

Ensure all entered details (e.g., UPI ID, wallet address) are accurate to prevent failed transactions. Even small errors can result in rejections or delays.

How to Verify Your Parimatch Account for Withdrawals

As mentioned above, account verification is an essential part of using Parimatch, and you can’t withdraw your winnings from the platform without completing it. This process ensures that your identity is authenticated, providing a secure environment for transactions. Verification is not just a regulatory requirement but also a way to safeguard your funds and personal data from unauthorized access. Once verified, you can enjoy smooth and hassle-free withdrawals without interruptions.

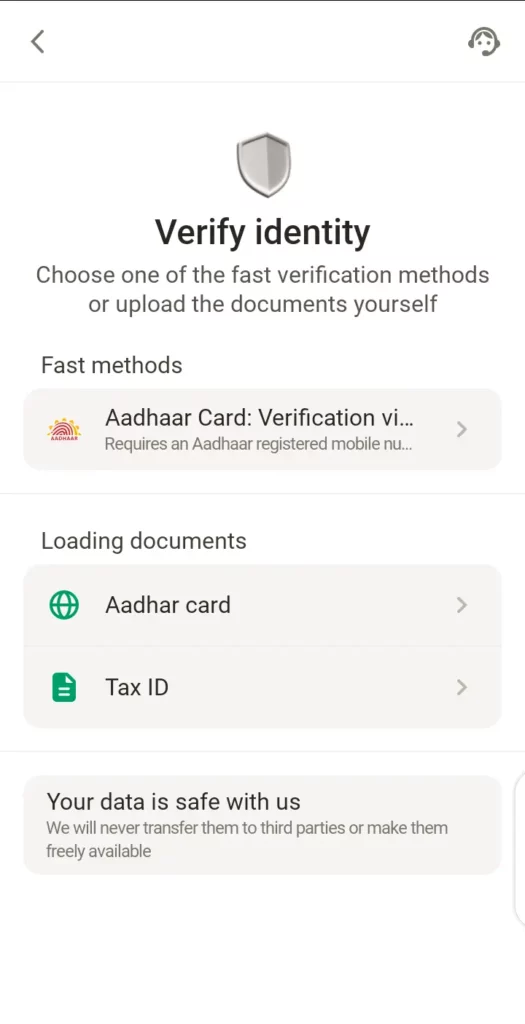

Below is a detailed step-by-step guide to completing your account verification on Parimatch:

Step 1: Log In to Your Parimatch Account

- Open the Parimatch mobile app or mobile site.

- Enter your registered username and password to log in.

Step 2: Access the Verification Section

- Navigate to the “Profile” section in the site or app.

- Select the “Verification” tab.

Step 3: Prepare Required Documents

Parimatch typically requires the following documents for verification:

- Proof of Identity: Passport, national ID card, or driver’s license.

- Proof of Address: Recent utility bill, bank statement, or any government-issued document with your address.

Ensure the documents are clear, unaltered, and show all necessary details. For example, a blurry photo may result in rejection.

Step 4: Upload the Documents

- Tap on the “Upload Documents” option in the verification section.

- Choose the type of document (identity, address, or payment method).

- Use your mobile camera or upload files directly from your device.

Step 5: Confirm and Submit

- Double-check the uploaded documents for clarity and accuracy.

- Submit the files for review by tapping the “Submit” or equivalent button.

Step 6: Wait for Verification Approval

- Parimatch’s team will review the documents, usually within 24–48 hours.

- You will receive a confirmation email or notification once your account is verified.

Step 7: Address Verification Issues (if any)

- If your documents are rejected, check the reason provided.

- Common issues include incomplete documents, mismatched details, or unclear images.

- Correct the issues and resubmit the required documents.

Common Challenges and How to Overcome Them

While Parimatch provides a seamless payment experience for most users, there can be occasional challenges. Here’s a detailed look at the common issues faced by Indian users during deposits or withdrawals on the mobile version and practical solutions to overcome them.

Failed Deposits

One of the most common challenges users face is a failed deposit transaction. This can occur due to various reasons:

- Insufficient Account Balance: If your linked bank account, UPI wallet, or e-wallet doesn’t have sufficient funds, the transaction will not go through.

Solution: Ensure your account has the necessary amount, including any potential transaction fees, before initiating a deposit.

- Payment Method Restrictions: Some banks or payment providers may block transactions related to online betting.

Solution: Use trusted methods like UPI (Google Pay, PhonePe), or consider using an e-wallet or cryptocurrency for unrestricted payments.

- Technical Glitches: Server downtime on either Parimatch or the payment provider’s end can cause a transaction to fail.

Solution: Wait for a few minutes and retry. If the problem persists, contact customer support for assistance.

- Incorrect Payment Details: Entering incorrect UPI IDs, card details, or wallet information can lead to payment failure.

Solution: Double-check all details before confirming a transaction.

Delayed Withdrawals

Withdrawals can sometimes take longer than expected, leading to user frustration. Common causes include:

- KYC Verification Pending: Parimatch requires users to complete the KYC process before processing withdrawals. If this is incomplete, the request will be delayed.

Solution: Upload all necessary documents (e.g., ID proof, address proof) and ensure they meet the platform’s requirements.

- Bank or Payment Processor Delays: Banks and third-party processors may have their own internal review periods.

Solution: Be patient and allow the stated processing time (usually 24–72 hours). Contact customer support if the delay extends beyond this.

- Mismatch in Account Details: If the withdrawal account details do not match the registered user name, the request may be denied.

Solution: Ensure all withdrawal details align with the registered Parimatch account information.

Currency Conversion Issues

Indian users may encounter difficulties if their bank or wallet doesn’t support INR for transactions.

- Solution: Choose INR as your primary currency on Parimatch during registration. If your bank account operates in a different currency, consider using an e-wallet or cryptocurrency to avoid conversion-related problems.

Limits on Transactions

Some users may find their deposits or withdrawals blocked due to exceeding minimum or maximum transaction limits.

- Solution: Familiarize yourself with the limits for each payment method. For example, UPI might have a daily cap imposed by the bank, while Parimatch may set its own thresholds.

Fraud Prevention Flags

Unusual account activity or multiple failed attempts may trigger Parimatch’s security system, leading to temporary account restrictions.

- Solution: Avoid multiple unsuccessful login or transaction attempts. Contact support to verify your account and resolve the issue promptly.

Support and Resolution for Persistent Issues

If you encounter challenges that you cannot resolve independently, Parimatch provides robust customer support:

- Live Chat: Available 24/7 through the app or mobile site for instant help.

- Email Support: Use the dedicated payments support email for detailed queries.

- FAQs and Guides: Check the Parimatch help center for self-service solutions.

Security Measures and User Protection

Ensuring secure and reliable transactions is a priority for Parimatch, particularly for Indian users accessing the mobile site and app. With a combination of advanced technology and user-focused practices, the platform guarantees the safety of all financial activities. Here’s a closer look at the security measures and user protection protocols in place:

Advanced Encryption Technology

Parimatch employs SSL (Secure Socket Layer) encryption to safeguard all data exchanged between users and the platform. This technology ensures that sensitive information, including payment details, remains encrypted and unreadable by unauthorized entities. Additionally, the use of HTTPS in the website and app provides an extra layer of security for users during transactions.

Secure Payment Gateways

All payment methods integrated into Parimatch are vetted for reliability and security. The platform partners with trusted payment processors, such as UPI services, e-wallets like Skrill and Neteller, and cryptocurrency providers, which employ their own stringent security and anti-fraud measures.

Two-Factor Authentication (2FA)

Parimatch encourages users to enable two-factor authentication (2FA) for account access. This feature adds an extra verification step, such as an OTP (One-Time Password) sent to the user’s registered mobile number or email, making unauthorized access nearly impossible.

Account Verification (KYC)

To prevent fraud and ensure compliance with legal standards, Parimatch mandates Know Your Customer (KYC) verification. Users must submit identification documents, such as Aadhaar or PAN cards, to verify their identity before making withdrawals. This step not only adds security but also streamlines transactions.

Anti-Fraud Measures

Parimatch has implemented sophisticated algorithms to monitor user activity for unusual behavior, such as multiple failed login attempts or suspicious transaction patterns. If any red flags are detected, the platform immediately freezes the account and notifies the user, preventing potential misuse.

User Responsibility for Account Security

While Parimatch provides robust security infrastructure, users are encouraged to take additional steps to protect their accounts:

- Use strong, unique passwords.

- Avoid sharing account details or OTPs with anyone.

- Regularly update passwords and account recovery information.

- Log out from the app or site after completing transactions.

Benefits of Using Parimatch Mobile Payments

Parimatch mobile payments are designed to offer Indian users a seamless, efficient, and secure transaction experience. Whether you’re depositing funds to start betting or withdrawing your winnings, the platform ensures that the process is smooth and hassle-free. Below are the key benefits that make Parimatch mobile payments stand out.

Wide Range of Payment Options

Parimatch supports various payment methods, including UPI, Netbanking, e-wallets, and cryptocurrencies. This diversity ensures that Indian users can choose a method that aligns with their preferences and banking access.

Fast Transactions

Deposits on Parimatch are processed almost instantly, allowing users to begin betting without delays. Withdrawals, once verified, are also completed quickly, providing faster access to winnings compared to many other platforms.

Top-Notch Security

Parimatch prioritizes user safety with advanced encryption and fraud prevention systems. These measures ensure that personal and financial information remains secure throughout all transactions.

User-Friendly Mobile Interface

The mobile platform is designed with simplicity in mind, offering an intuitive interface for managing deposits and withdrawals. Clear instructions and smooth navigation make the process easy, even for first-time users.

Reliable Customer Support

A dedicated support team is available 24/7 to resolve payment-related issues. From technical assistance to addressing concerns, users can rely on prompt and effective help whenever needed.

Welcome Bonus on the First Deposit

Parimatch’s welcome bonus is a great incentive for new users, providing an exciting opportunity to maximize their initial deposit. Tailored for both sports bettors and casino enthusiasts, it allows users to choose a bonus that best suits their interests. Below is a detailed breakdown.

Sports Bonus

- Offer: 150% of your deposit, up to ₹20,000.

- Eligibility: Minimum deposit of ₹200 for first-time users.

- Wagering Requirement: 16x on single bets with minimum odds of 1.9.

- Timeframe: Must be used within 14 days of registration.

Casino Bonus

- Offer: 150% of your deposit, up to ₹105,000.

- Eligibility: Minimum deposit of ₹350.

- Wagering Requirement: 30x on eligible slot games in the casino section

- Timeframe: Valid for 30 days after signup.

Conclusion

Parimatch stands out as a reliable and user-friendly platform for Indian mobile users, offering seamless deposit and withdrawal processes. With a wide range of payment methods, from UPI to cryptocurrencies, it ensures convenience and flexibility for every bettor. The platform’s robust security measures and dedicated customer support provide a safe and hassle-free experience.

By following the step-by-step guides and tips provided in the comprehensive overview, users can maximize their experience on Parimatch. Whether you’re a seasoned bettor or new to the platform, the platform ensures smooth transactions, enabling you to focus on what truly matters—enjoying your betting journey.

Frequently Asked Questions (FAQs)

- What is the minimum deposit amount on Parimatch?

The minimum deposit varies by payment method but typically starts at ₹300 for most options like UPI and e-wallets.

- How long do withdrawals take to process?

Withdrawals are processed within 24-48 hours for most methods, though UPI and e-wallets may be faster.

- Are there fees for transactions?

Parimatch does not charge fees for deposits or withdrawals, but your bank or payment provider might.

- Can I deposit using cryptocurrency?

Yes, Parimatch supports popular cryptocurrencies like Bitcoin and Ethereum for deposits and withdrawals.

- What happens if my deposit fails?

Check your payment details, ensure sufficient balance, and retry. If the issue persists, contact Parimatch support.

- Is KYC mandatory for withdrawals?

Yes, completing KYC verification is required to withdraw funds to ensure account security.

- Can I use Indian rupees for transactions?

Yes, Parimatch supports INR for deposits and withdrawals, making it convenient for Indian users.