Parimatch has established itself as one of the most popular online betting platforms worldwide, offering a wide range of options for sports betting and casino games. For Indian users, especially those accessing the platform through its mobile site or app, the ease of managing finances is a crucial aspect of the experience. A streamlined withdrawal process ensures that players can quickly and securely access their winnings without hassle.

For mobile users, Parimatch has optimized its platform to cater to the growing demand for efficient financial transactions. Whether you’re using the Parimatch mobile site or app, the withdrawal process has been designed to be straightforward, reliable, and user-friendly. From initiating a withdrawal request to receiving funds in your bank account or digital wallet, the process is seamless and supports a variety of methods popular in India, including UPI, Paytm, and Neteller.

This article delves into every detail of Parimatch withdrawals, specifically tailored to Indian users on mobile. You’ll discover step-by-step guides, popular methods, troubleshooting tips, and much more. Get ready to explore everything you need to know to withdraw your winnings efficiently and confidently.

Understanding Withdrawals at Parimatch

Parimatch withdrawals are a vital aspect of the user experience, especially for Indian users engaging with the platform via its mobile site and app. A seamless withdrawal process ensures trust and satisfaction among users, reflecting the platform’s commitment to providing a user-centric experience. This section delves into the key features and essentials of withdrawals at Parimatch, with a specific focus on the needs of Indian bettors.

The Withdrawal Process: An Overview

At Parimatch, the withdrawal process has been designed to be straightforward and intuitive, ensuring that users can access their winnings with minimal hassle. Once you’ve accumulated funds in your account, the platform allows you to withdraw them through a variety of methods tailored to the Indian market. However, certain prerequisites, such as account verification, must be met to ensure compliance with security and regulatory standards.

Parimatch emphasizes providing a secure environment for financial transactions, ensuring that user data is protected and funds are transferred safely. With several withdrawal methods available, users can select an option that best suits their preferences, whether they prioritize speed, convenience, or low fees.

Key Features of Withdrawals at Parimatch

- Ease of Use:

The mobile interface of Parimatch has been optimized for user convenience, with clear navigation and simple instructions for initiating withdrawals. Both the mobile site and app are equipped with intuitive designs that make the process accessible even for first-time users.

- Fast Processing Times:

Depending on the selected withdrawal method, funds are processed quickly, often within 24 to 72 hours. Popular methods like UPI and e-wallets generally offer faster payouts compared to traditional bank transfers.

- Diverse Options:

Recognizing the preferences of Indian users, Parimatch supports a range of withdrawal methods, including bank transfers, UPI, e-wallets (like Paytm, Skrill, and Neteller), and cryptocurrency. This flexibility ensures that users can choose methods that align with their specific needs.

- Localized Support for Indian Users:

The platform caters specifically to Indian users by integrating widely-used payment options such as UPI and Paytm. Additionally, transactions can be conducted in INR, eliminating the need for currency conversion and related fees.

Importance of Verified Accounts

Before initiating a withdrawal, users must ensure that their account is fully verified. This involves completing the Know Your Customer (KYC) process, which includes submitting identification documents and proof of address. Account verification is essential for the following reasons:

- Security: To protect against unauthorized access and fraudulent transactions.

- Compliance: To adhere to local regulations and anti-money laundering policies.

- Smooth Withdrawals: Only verified accounts can process withdrawals on Parimatch without hassles.

To avoid interruptions, it’s recommended that users complete the KYC process immediately after registering on Parimatch.

Popular Withdrawal Methods for Indian Users

Parimatch provides various withdrawal options tailored to Indian users. These include instant options like UPI and e-wallets for those who prioritize speed, as well as more traditional methods like bank transfers for those who value direct transactions to their accounts. Each method comes with its unique advantages, ensuring there’s a suitable option for everyone.

Why Withdrawal Methods Matter in Online Gaming

When it comes to online casino and sports betting platforms, the importance of withdrawal methods cannot be overstated. They are not merely a feature but a cornerstone of trust, convenience, and user satisfaction. Here’s why withdrawal methods matter so profoundly in online gaming, especially for users in regions like India.

User Trust and Platform Credibility

Withdrawal methods play a critical role in establishing trust between users and the platform. Players need the assurance that their winnings can be accessed without hassle. Transparent, reliable, and diverse withdrawal methods signal that a platform values its users and operates legitimately. A platform that consistently fails to provide timely withdrawals risks losing its credibility, no matter how enticing its games or bonuses may be.

Accessibility for Diverse User Groups

A wide range of withdrawal methods ensures accessibility for different demographics. In countries like India, where financial habits vary widely, offering options such as UPI, bank transfers, and e-wallets like Paytm or Skrill caters to diverse user preferences. By accommodating these methods, platforms can appeal to both tech-savvy players and those who rely on more traditional banking channels.

Speed and Convenience

The speed at which players can withdraw their funds is one of the most significant determinants of a positive user experience. Instant or same-day withdrawals are becoming industry standards. Players are more likely to stick with platforms that prioritize efficiency, especially when compared to those with sluggish processing times. Fast withdrawals often lead to higher customer satisfaction and loyalty.

Security and Data Protection

In the digital age, security is a non-negotiable aspect of online gaming withdrawals. Reliable platforms implement advanced technologies like SSL (Secure Sockets Layer) encryption to safeguard user data and financial transactions. SSL ensures that all information exchanged between the user and the platform is encrypted, protecting it from potential cyber threats like hacking or data breaches.

Moreover, secure withdrawal methods incorporate multi-factor authentication (MFA) and other identity verification processes, ensuring that only legitimate users can access their funds. These measures not only protect users’ money but also fortify the platform’s reputation as a safe and trustworthy operator.

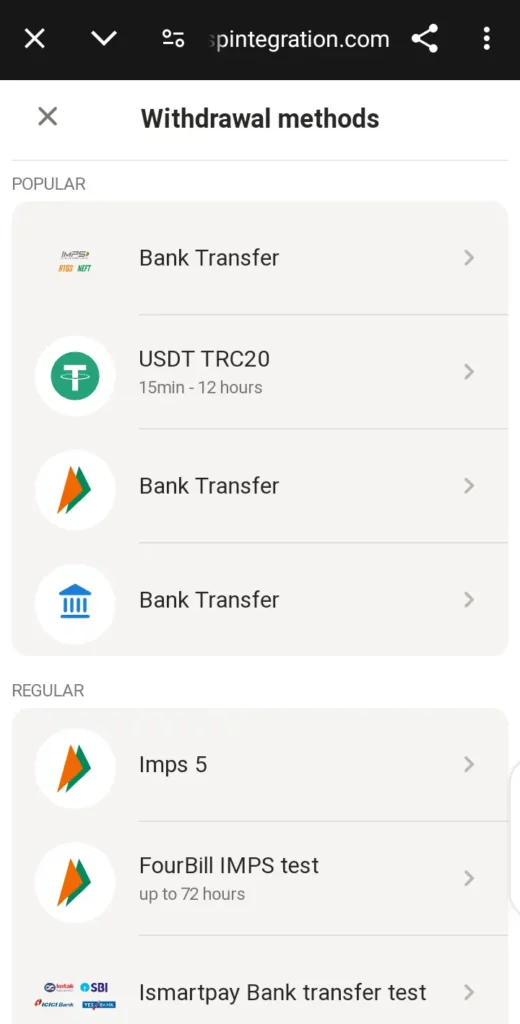

Popular Withdrawal Methods for Indian Users

Parimatch offers a variety of withdrawal methods tailored to suit the preferences of Indian users. These methods include traditional bank transfers, digital wallets, and cryptocurrencies. In this section, we’ll explore the available options in detail, highlighting their benefits, drawbacks, and suitability for different user needs.

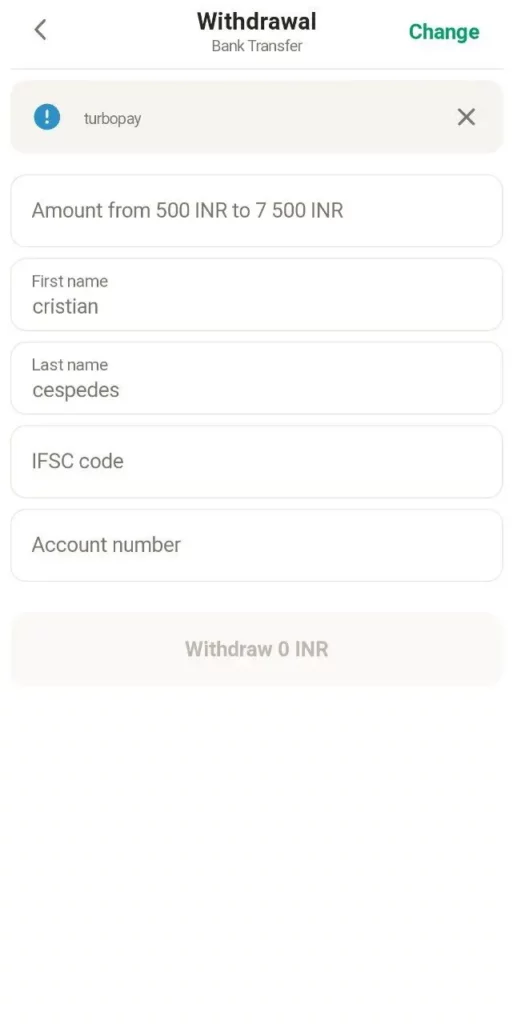

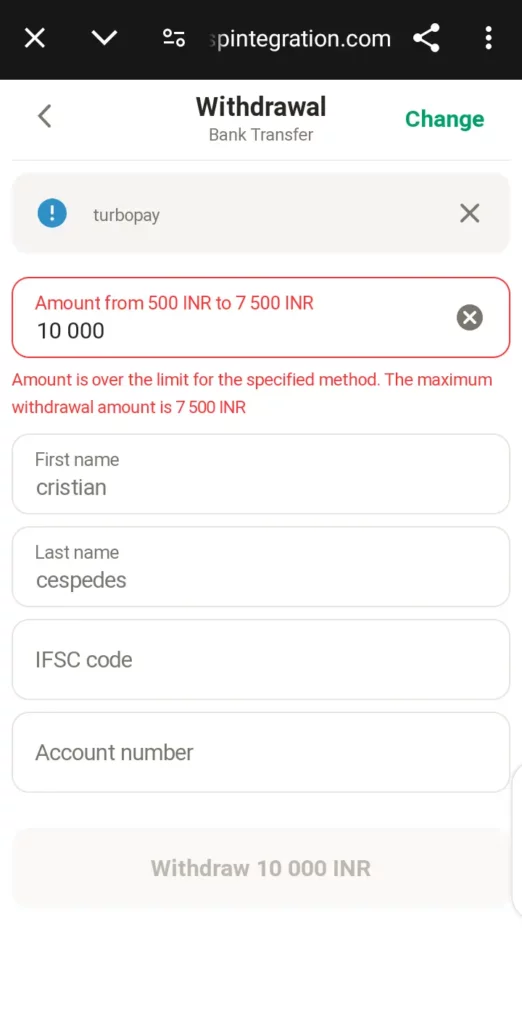

Bank Transfers (IMPS)

Bank transfers through IMPS (Immediate Payment Service) are a popular choice for Indian users due to their direct and reliable nature.

- Minimum Withdrawal: ₹500

- Maximum Withdrawal: ₹7,500

- Processing Time: Up to 48 hours

Pros:

- Widely accepted and easy to use.

- No need for third-party apps or accounts.

- Familiarity with users new to online betting platforms.

Cons:

- Processing times are relatively slower compared to digital methods.

- Users may encounter additional bank fees.

IMPS is ideal for users who prefer traditional banking and are not in a rush to receive their funds. However, the processing time of up to 48 hours may be a limitation for those seeking instant withdrawals.

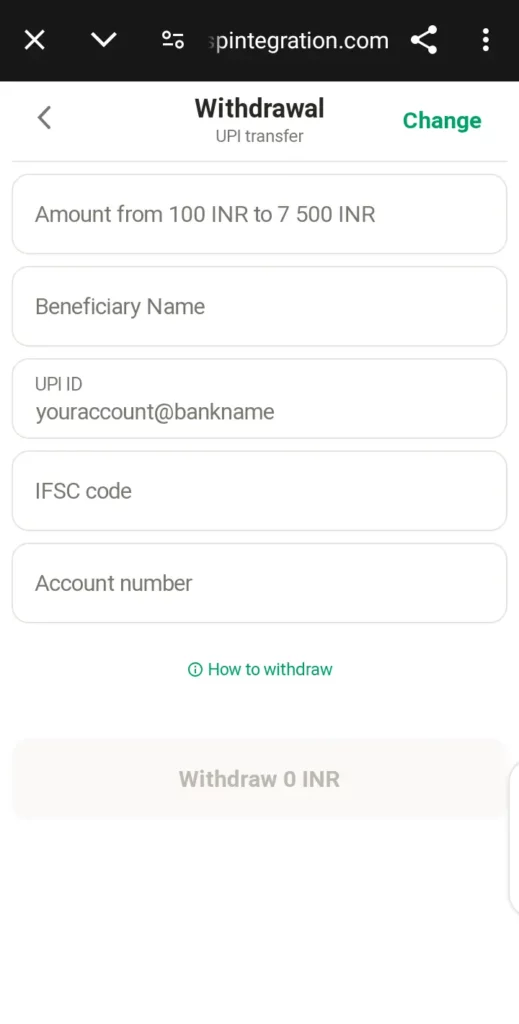

UPI Transfers

Unified Payments Interface (UPI) is one of the most widely used digital payment methods in India, offering simplicity and convenience.

- Minimum Withdrawal: ₹100

- Maximum Withdrawal: ₹7,500

- Processing Time: Up to 48 hours

Pros:

- Low Parimatch minimum withdrawal limit amount.

- UPI is widely supported by Indian banks and mobile payment apps like Google Pay, PhonePe, and Paytm.

- Secure and familiar for Indian users.

Cons:

- Processing times can be slower compared to e-wallets and cryptocurrencies.

UPI is a great choice for users who prefer a widely recognized and straightforward method for their transactions. Its low minimum withdrawal limit makes it accessible for small-scale bettors.

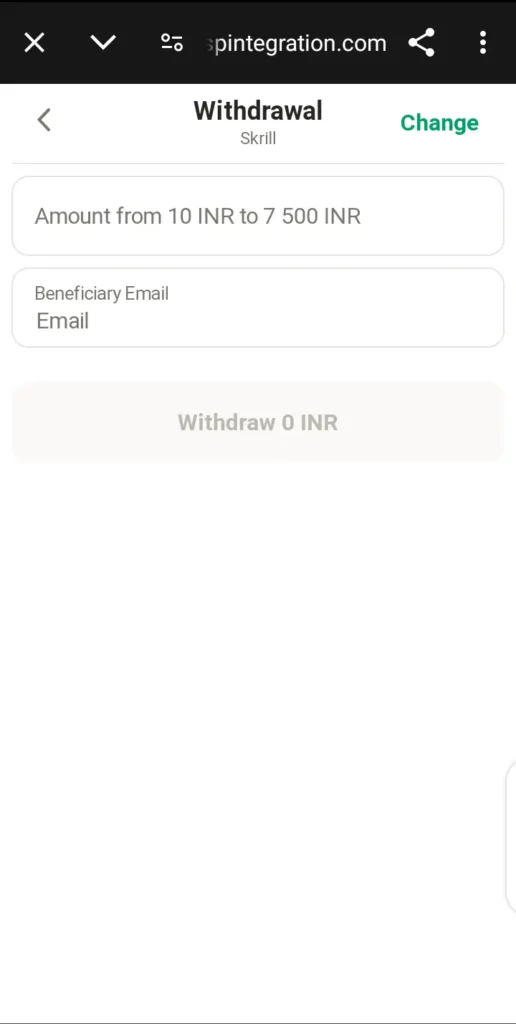

Skrill

Skrill is a popular e-wallet solution that offers fast and secure transactions, making it a favorite among online betting enthusiasts.

- Minimum Withdrawal: ₹10

- Maximum Withdrawal: ₹7,500

- Processing Time: Up to 1 hour

Pros:

- Extremely low minimum withdrawal amount of ₹10.

- Quick processing times, usually under an hour.

- Allows users to withdraw funds directly to their Skrill wallet, which can then be transferred to a bank account or used for other online transactions.

Cons:

- Skrill account setup and verification may be required.

Skrill is an excellent option for users who prioritize speed and flexibility, especially those who frequently transact online.

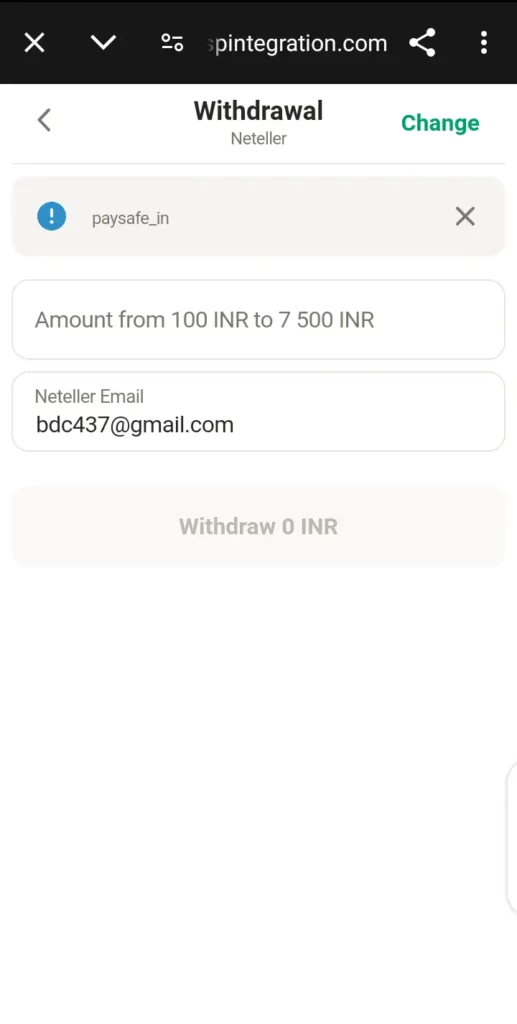

Neteller

Neteller, another widely used e-wallet, is known for its efficiency and ease of use.

- Minimum Withdrawal: ₹100

- Maximum Withdrawal: ₹7,500

- Processing Time: Up to 1 hour

Pros:

- Quick and reliable transactions with a processing time of up to 1 hour.

- Suitable for users familiar with e-wallet systems.

- High level of security and user protection.

Cons:

- Similar to Skrill, Neteller may charge fees for certain transactions.

- Requires a verified Neteller account for withdrawals.

Neteller is ideal for users who want a fast and secure withdrawal method and already have an established e-wallet account.

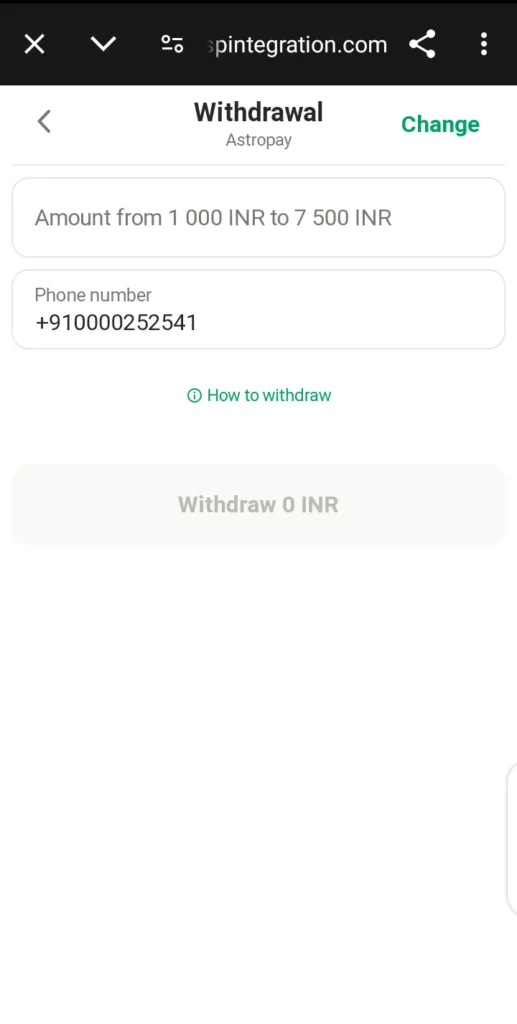

Astropay

Astropay is a digital payment method that has gained traction among Indian users due to its convenience and speed.

- Minimum Withdrawal: ₹1,000

- Maximum Withdrawal: ₹7,500

- Processing Time: Up to 1 hour

Pros:

- Quick processing times, usually under an hour.

- No bank account details are required to ensure privacy.

- Compatible with mobile devices.

Cons:

- Slightly higher minimum withdrawal amount compared to IMPS.

- Users need to create and fund an Astropay account.

Astropay is perfect for users who value privacy and speed. It’s an excellent option for those who prefer a digital payment solution without sharing their banking details directly with the platform.

Cryptocurrencies

Parimatch supports a range of cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Tether (TRC-20). These methods are particularly appealing to tech-savvy users and those who value anonymity.

Common Features:

- Maximum Withdrawal: ₹7,500

- Processing Time: 15 minutes to 12 hours

1. Bitcoin:

- Minimum Withdrawal: ₹2,000

Processing Time: 15 minutes to 12 hours

2. Ethereum:

- Minimum Withdrawal: ₹1

- Processing Time: 15 minutes to 12 hours

3. Bitcoin Cash:

- Minimum Withdrawal: ₹20

- Processing Time: 15 minutes to 12 hours

4. Litecoin:

- Minimum Withdrawal: ₹100

- Processing Time: 15 minutes to 12 hours

5. Tether (TRC-20):

- Minimum Withdrawal: ₹500

- Processing Time: 15 minutes to 12 hours

Pros:

- Fast processing times, with some transactions completed in as little as 15 minutes.

- High level of anonymity and security.

- No involvement of traditional banks.

Cons:

- Requires a basic understanding of cryptocurrencies and wallets.

- Volatility in cryptocurrency values can pose risks.

Among cryptocurrencies, Bitcoin Cash stands out due to its incredibly low minimum withdrawal amount of ₹20, making it accessible to a wider audience. With its higher minimum of ₹1,800, Ethereum may be less appealing for users withdrawing smaller amounts.

Withdrawal Table

Here’s a quick look at the withdrawal methods available for Indian users on Parimatch. The table below highlights the minimum and maximum limits and the processing times for each method.

| Method Name | Min Withdrawal | Max Withdrawal | Processing Time |

| IMPS | 500 | 7,500 | Up to 48 hours |

| UPI Transfer | 100 | 7,500 | Up to 48 hours |

| Skrill | 10 | 7,500 | Up to 1 hour |

| Neteller | 100 | 7,500 | Up to 1 hour |

| Astropay | 1,000 | 7,500 | Up to 1 hour |

| Bitcoin | 2,000 | 7,500 | 15 minutes – 12 hours |

| Ethereum | 1 | 7,500 | 15 minutes – 12 hours |

| Bitcoin Cash | 20 | 7,500 | 15 minutes – 12 hours |

| Litecoin | 100 | 7,500 | 15 minutes – 12 hours |

| Tether TRC-20 | 500 | 7,500 | 15 minutes – 12 hours |

Comparison of Processing Times and Fees

When choosing a withdrawal method, processing time and potential fees are critical factors. Cryptocurrencies offer the fastest processing times (15 minutes to 12 hours), followed by Astropay (up to 1 hour), and finally, IMPS (up to 48 hours). While cryptocurrencies are efficient, they may not be suitable for users unfamiliar with digital assets. IMPS, on the other hand, is a reliable fallback for users who prefer conventional banking.

Tailoring Choices to Indian Users’ Preferences

For Indian users, the selection of withdrawal methods largely depends on individual preferences:

- For Speed: Cryptocurrencies like Bitcoin and Bitcoin Cash or Astropay.

- For Simplicity: IMPS.

- For Anonymity: Cryptocurrencies.

- For Low Minimum Withdrawals: Bitcoin Cash (₹20) or IMPS (₹500).

Users have access to a wide array of Parimatch withdrawal options, catering to both traditional and modern payment preferences.

Step-by-Step Guide to Withdrawing Funds on Parimatch Mobile

When it comes to withdrawing funds from Parimatch using the mobile platform, the process is designed to be seamless and user-friendly. Whether you’re accessing Parimatch through the mobile site or app, this guide will walk you through each step to ensure a smooth experience.

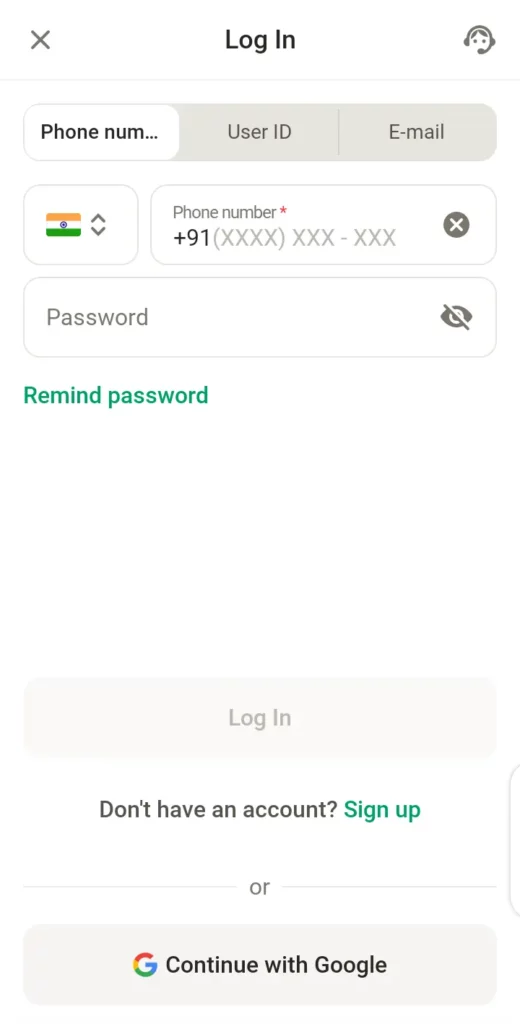

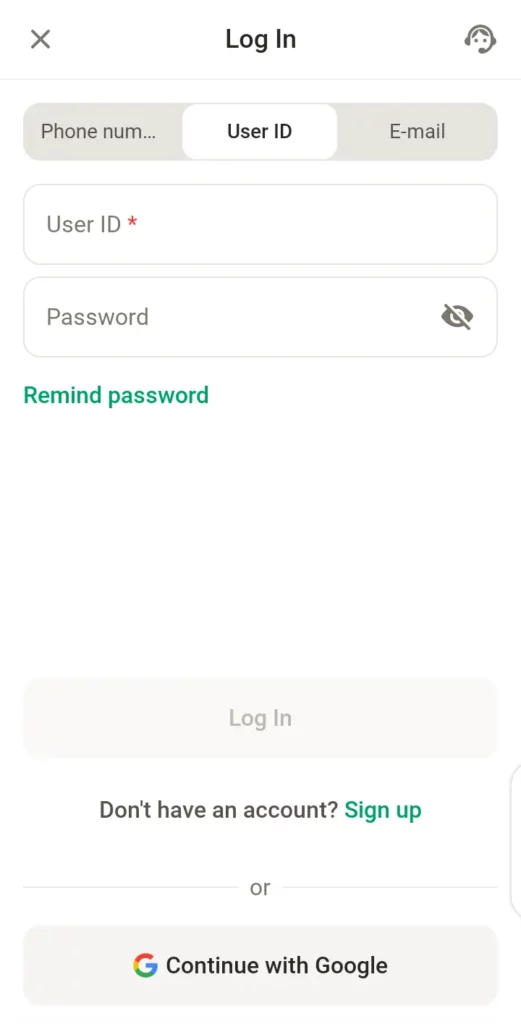

- Logging into Your Parimatch Account

Before initiating a withdrawal, ensure you are logged into your verified Parimatch account.

- Open the Parimatch mobile site or app on your device.

- Enter your login credentials (registered mobile number/email and password).

- If you’ve enabled two-factor authentication (2FA), complete the verification step to proceed.

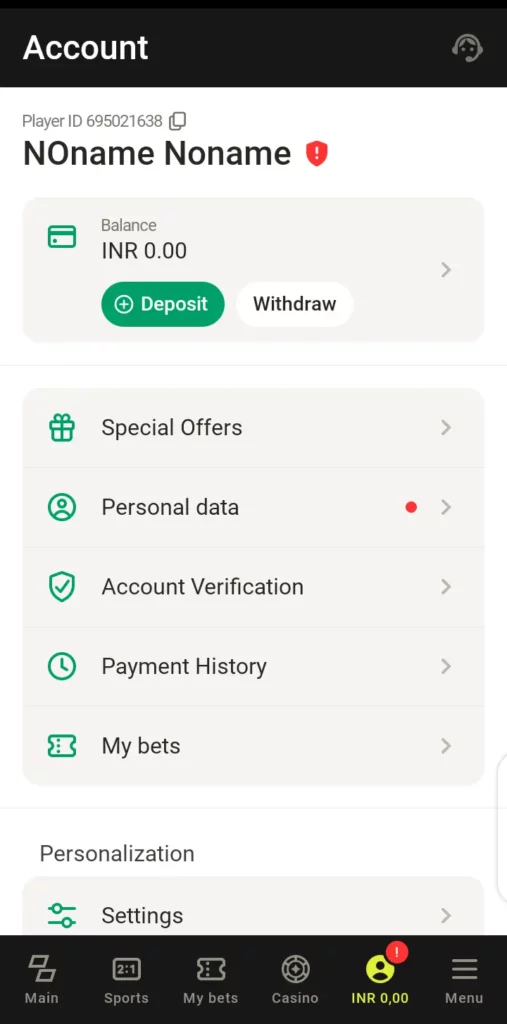

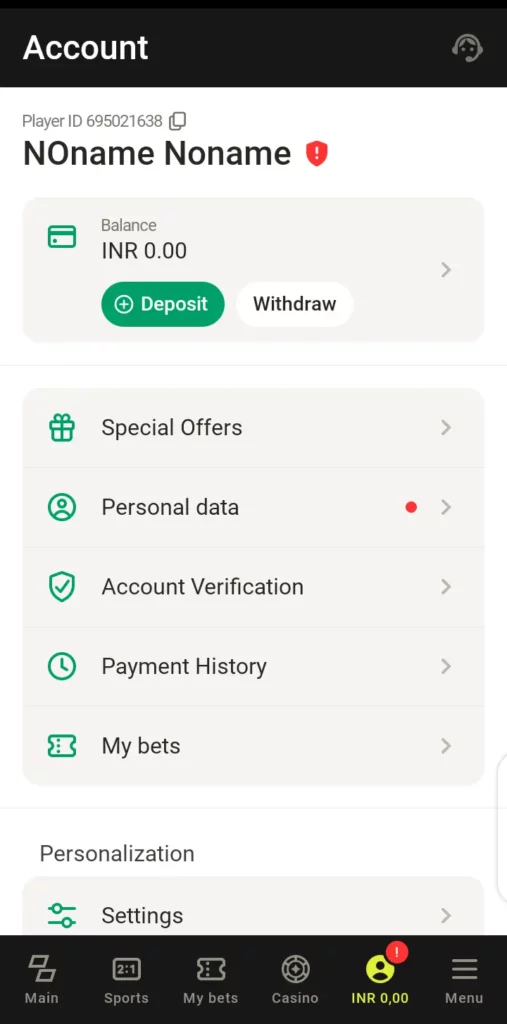

- Navigating to the Withdrawal Section

Once logged in, accessing the Parimatch withdrawal section is straightforward:

- On the home screen, locate the menu icon (usually represented by three horizontal lines in the bottom-right corner).

- From the dropdown menu, select “My Account.”

- Click on the “Withdraw” option to proceed.

The interface is intuitive, making it easy to identify withdrawal-related options.

- Choosing Your Preferred Withdrawal Method

Parimatch offers a variety of withdrawal methods tailored to Indian users, such as:

- Bank Transfers

- UPI (Unified Payments Interface)

- E-wallets (like Paytm, Skrill, Neteller).

- Cryptocurrency options like Bitcoin and Ethereum.

Select your preferred method based on convenience, speed, and fees. Once you’ve chosen, proceed to the next step.

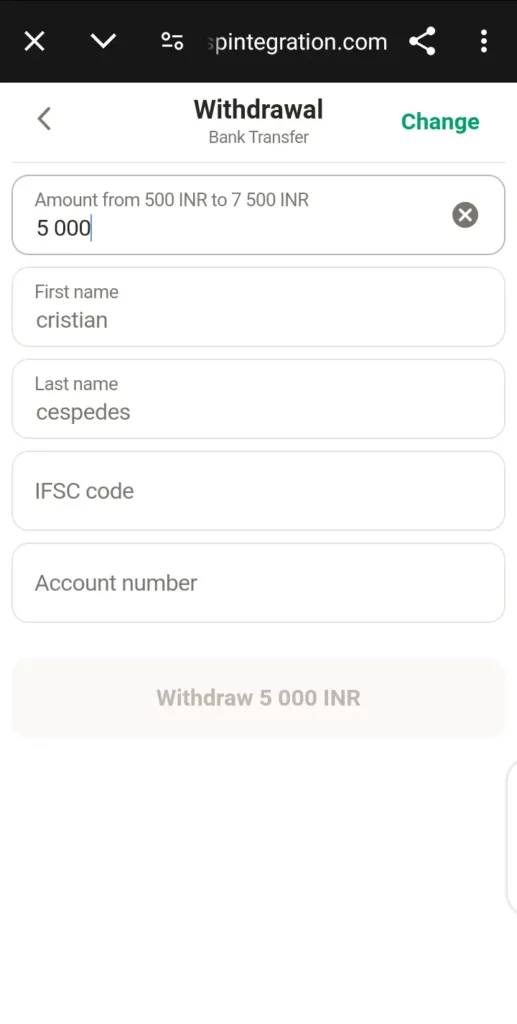

- Entering the Withdrawal Amount

After selecting a withdrawal method, you’ll need to specify the amount you wish to withdraw:

- Enter the amount in INR.

- Ensure it is within the minimum and maximum limits set by Parimatch for the chosen method. For instance, UPI withdrawals might have a Parimatch minimum withdrawal limit of ₹100, while bank transfers may require a higher threshold.

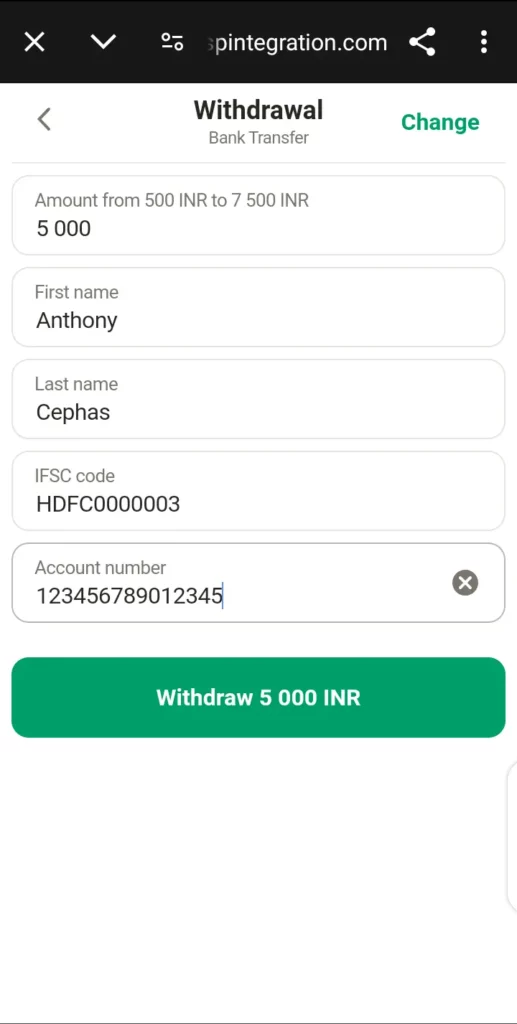

- Provide the Required Information

Depending on the withdrawal option, you may be prompted to provide the following:

- For UPI: Input the unique UPI handle associated with your payment app (e.g., abc@bank).

- For Bank Transfers: Enter your bank account credentials, including the account number and the bank’s IFSC code.

- For Digital Wallets: Provide the email or phone number linked to your e-wallet account.

- For Crypto Withdrawals: Carefully paste your crypto wallet address. Be precise here, as even a minor error can result in the loss of funds.

- Confirming the Withdrawal Request

After entering the details and completing verification:

- Review all the information provided, including the withdrawal amount and payment method.

- Click on “Submit” or “Confirm” to finalize your request.

- You’ll receive a confirmation notification on your registered mobile number or email.

- Monitoring Withdrawal Status

After submitting the request, Parimatch allows you to track the status of your withdrawal:

- Go to the “Transaction History” section under “My Account.”

- Locate your recent withdrawal request and check its status:

Pending: The request is being processed.

Completed: The funds have been transferred using your selected method.

Rejected: The request was unsuccessful (reasons will be mentioned).

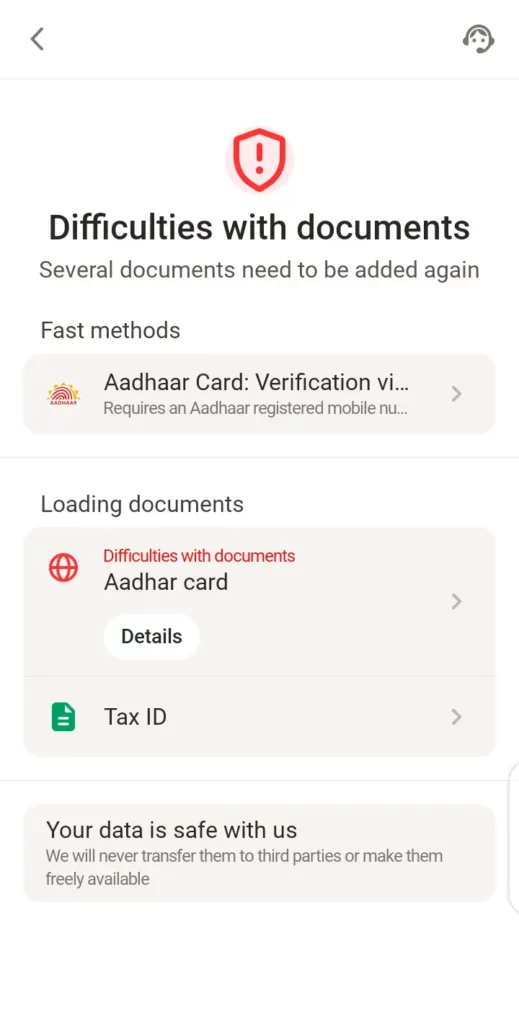

How to Verify Your Parimatch Account

Verification, commonly referred to as KYC (Know Your Customer), is a crucial process on Parimatch that ensures the security and legitimacy of all financial transactions. Without completing KYC verification, you cannot withdraw funds from your Parimatch account.

This verification is not only a compliance requirement but also protects users from fraudulent activities and ensures that withdrawals are processed smoothly. For Indian users, Parimatch offers a streamlined verification process via the mobile app and website, making it convenient to complete this step and enjoy seamless withdrawals. Follow the step-by-step guide to verify your account.

1. Login to Your Parimatch Account

- Open the Parimatch mobile app or mobile site.

- Log in using your registered credentials. If you don’t have an account, you’ll need to create one and complete the registration process before proceeding.

2. Navigate to the Verification Section

- After logging in, click on the menu icon and then on your account

- Select the “Account Verification” option from the dropdown menu

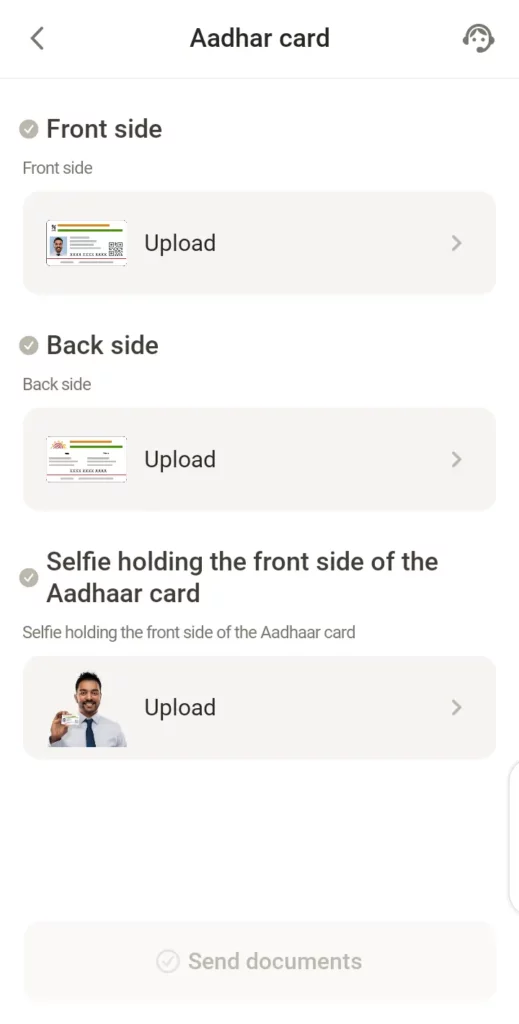

3. Prepare the Required Documents

To complete verification, you’ll need to upload documents that confirm your identity and address. The Commonly accepted proof of identity documents arethe Aadhaar card and PAN card.

Alternatively, you can choose the “Fast Aadhaar verification” option. It verifies your account by SMS after you enter your 12-digit Aadhaar card number. The verification code is sent to your Aadhaar-linked mobile number, and your account is verified shortly after.

4. Upload the Documents

- Use your mobile camera to take clear, high-resolution photos of the required documents.

- Upload these images in the relevant sections of the KYC form on the Parimatch platform. Ensure the images are not blurry and all details are clearly visible.

- You will also be asked to upload a clear selfie of you holding the ID card next to your face.

5. Submit Your Details

- Double-check the information and documents for accuracy.

- Click on “Send Documents” after uploading. The platform will send your details to their verification team.

6. Wait for Approval

- Verification usually takes 24–48 hours, but this can vary depending on the volume of requests. You’ll receive a notification or email once your account is successfully verified.

- If there’s an issue with the documents, Parimatch will notify you to resubmit or correct the details.

Troubleshooting Common Withdrawal Issues on Parimatch

Withdrawals are a critical aspect of any online betting platform, and while Parimatch strives to make the process seamless, users may occasionally encounter challenges. Here, we address common withdrawal issues faced by users and provide actionable solutions, focusing on Indian users accessing the platform via the mobile site or app.

Delayed Withdrawal Processing

One of the most common complaints is the delay in processing withdrawal requests. While Parimatch aims to process withdrawals quickly, several factors can cause delays:

- Unverified Account: If your account is not fully verified, your withdrawal request might be held up.

- Bank Delays: For methods like bank transfers, the processing time depends on the bank’s internal procedures.

- High Traffic Periods: Withdrawals requested during peak periods, such as after major sporting events, might take longer.

Solution:

- Ensure your account is fully verified by completing the KYC process (uploading identification documents and proof of address).

- Use e-wallets or UPI for faster transactions compared to traditional bank transfers.

- Plan withdrawals in advance to avoid peak traffic delays.

Rejected Withdrawal Requests

Parimatch withdrawal requests may sometimes be rejected for various reasons, including:

- Incorrect or mismatched bank details.

- Requesting withdrawals below or above the minimum limit.

- Attempting to withdraw via a method different from the one used for deposits.

Solution:

- Double-check all details before submitting your withdrawal request, especially bank account or e-wallet information.

- Familiarize yourself with Parimatch’s withdrawal limits for your chosen method.

- Always use the same payment method for deposits and withdrawals to avoid compliance issues.

Funds Not Credited After Approval

In some cases, users report that their withdrawal status shows as “approved,” but the funds have not been credited to their account. This issue can occur due to:

- Delays at the bank or payment gateway level.

- Issues with the e-wallet or payment app being used.

Solution:

- Check with your bank or payment app for any processing delays on their end.

- Contact Parimatch customer support with the transaction ID and other relevant details to investigate the issue further.

- Retain screenshots of the withdrawal confirmation for a quick resolution.

Withdrawal Limits Exceeded

Users often face problems when trying to withdraw amounts beyond the set daily, weekly, or monthly limits. Parimatch enforces these limits to ensure financial security and compliance with regulations.

Solution:

- Check Parimatch’s withdrawal limits for your account type and payment method before requesting a withdrawal.

- Split larger withdrawal amounts into multiple requests within the allowed limits.

- Upgrade your account verification level if higher withdrawal limits are required.

Account Flagged for Suspicious Activity

Parimatch’s security systems may flag accounts for suspicious activity, leading to withdrawal holds. Triggers include:

- Using multiple accounts from the same IP address.

- Engaging in irregular betting patterns.

- Attempting to withdraw large sums without sufficient betting activity.

Solution:

- Adhere to Parimatch’s terms and conditions to avoid triggering security flags.

- Use only one account per user and ensure all account information is accurate and up to date.

- Contact customer support if your account is flagged to clarify and resolve the issue.

Technical Glitches on the Mobile Platform

Mobile users may occasionally face technical issues, such as app crashes or errors during withdrawal submission.

Solution:

- Update the Parimatch app to the latest version to avoid bugs and glitches.

- Switch to the mobile site if the app is not functioning properly.

- Clear your browser’s cache or app data and try again.

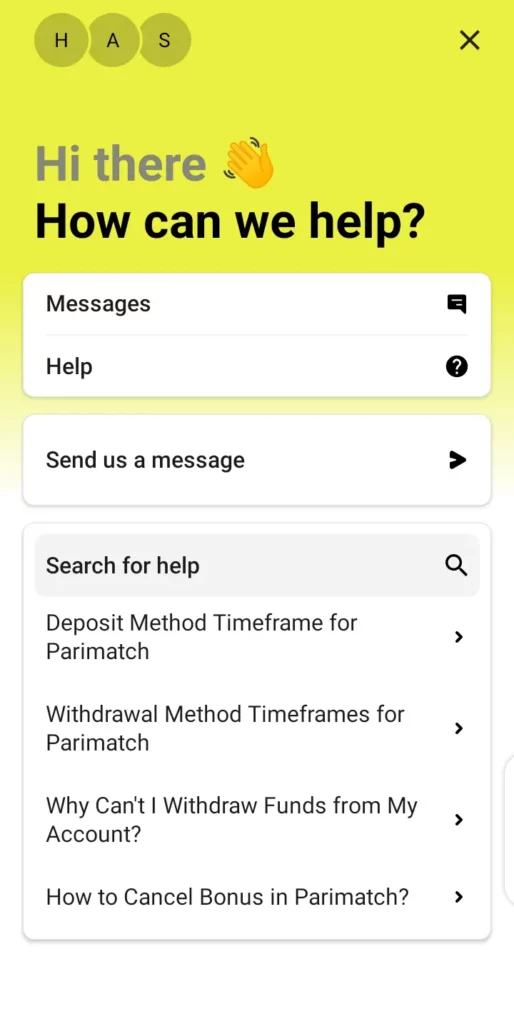

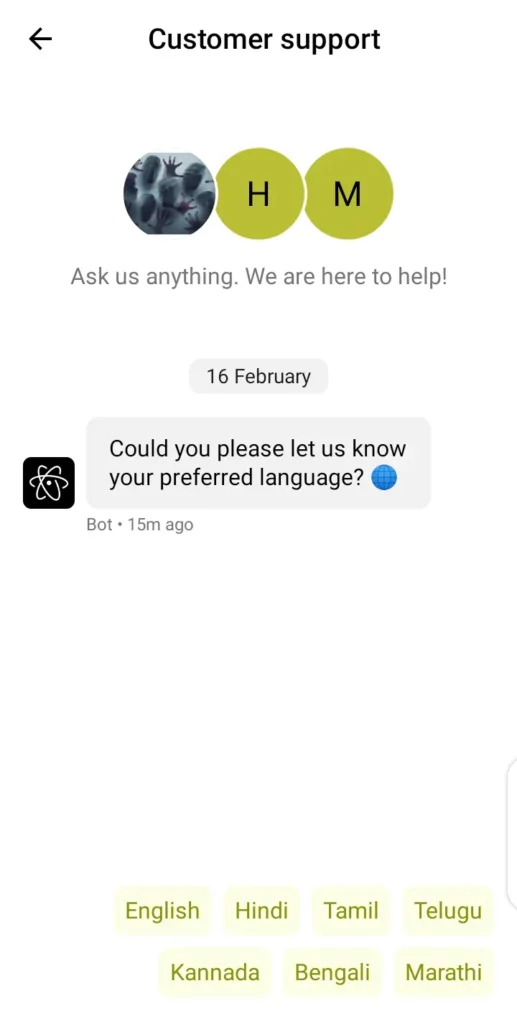

How to Contact Parimatch Support for Withdrawal Issues

If you’re unable to resolve an issue on your own, Parimatch offers multiple support channels for Indian users:

- Live Chat: Available directly on the app or mobile site for real-time assistance.

- Email Support: Write to Parimatch support with detailed information about your issue.

- FAQ Section: Review the FAQ section for common withdrawal-related queries.

Tips for Effective Communication:

- Provide all necessary details, including your account ID, transaction ID, and screenshots.

- Be polite and concise to expedite resolution.

- By following these solutions and best practices, you can minimize or resolve withdrawal issues efficiently, ensuring a smooth experience on Parimatch’s mobile platform.

Tips for Faster and Secure Withdrawals at Parimatch

When it comes to withdrawals on Parimatch, efficiency and security are top priorities for Indian users. Follow these practical tips to ensure your withdrawals are processed quickly and without complications:

Complete Account Verification (KYC) Early

One of the most important steps to ensure smooth withdrawals is completing the Know Your Customer (KYC) process.

- Why It Matters: Parimatch requires verified accounts to process withdrawals as part of their anti-fraud and compliance measures.

- How to Do It: Submit valid documents such as your PAN card or Aadhaar card for verification. Ensure the details match those on your Parimatch account and bank/e-wallet.

- Pro Tip: Complete KYC during registration or as soon as possible to avoid withdrawal delays.

Use the Same Method for Deposits and Withdrawals

- Why It Matters: Parimatch prefers users to use the same payment method for deposits and withdrawals to comply with anti-money laundering (AML) regulations.

- Benefits: This reduces the chances of delays or complications during processing.

- Example: If you deposited via UPI, request withdrawals using the same UPI ID.

Keep Your Payment Details Updated

- Why It Matters: Outdated or incorrect payment details can result in failed or delayed withdrawals.

- How to Do It: Regularly update your payment information, such as bank account numbers or e-wallet details, in your Parimatch account.

- Pro Tip: Double-check your details before submitting a withdrawal request to avoid errors.

Plan Your Withdrawals According to Processing Times

Why It Matters: Different payment methods have varying processing times. For example:

- E-wallets like Paytm or Neteller: Instant or within 24 hours.

- Bank transfers: 2–5 business days.

- Cryptocurrencies: Instant, depending on blockchain confirmations.

Pro Tip: Use faster methods like e-wallets or UPI if you need funds urgently. Avoid initiating withdrawals on weekends or public holidays to prevent additional delays.

Avoid Small, Frequent Withdrawals

- Why It Matters: Some platforms, including Parimatch, may impose fees or delays for multiple small transactions.

- How to Optimize: Request larger, consolidated withdrawals to minimize processing times and fees.

Follow Responsible Betting Practices

- Why It Matters: Suspicious betting behavior, such as unusually high or frequent bets, might flag your account for review, delaying withdrawals.

- How to Avoid Issues: Maintain consistent, responsible betting patterns and avoid using multiple accounts.

Keep Records of Your Transactions

- Why It Matters: In case of disputes or delays, having a clear record of your deposits and withdrawals can help resolve issues faster.

- How to Do It: Save receipts, screenshots, or email confirmations of your transactions.

Reach Out to Customer Support When Needed

- Why It Matters: If your withdrawal is delayed or you face any issues, Parimatch’s customer support team can assist.

- How to Contact: Use the live chat feature on the mobile app or website or email the support team.

- Pro Tip: Provide your transaction ID and all necessary details when raising a query for faster resolution.

Use a Stable Internet Connection

- Why It Matters: A poor connection during withdrawal requests can result in errors or incomplete transactions.

- How to Ensure Stability: Use a secure and reliable internet connection, especially for mobile users. Avoid public Wi-Fi networks or use VPNs with them for added security.

Security Measures and User Protection at Parimatch

Ensuring the security of user funds and personal data is a top priority for Parimatch. The platform has implemented multiple layers of protection to provide users with a safe and secure withdrawal experience. Here’s an in-depth look at the measures taken by Parimatch to safeguard its users:

Advanced Encryption Technology

Parimatch employs cutting-edge SSL (Secure Socket Layer) encryption technology to protect all financial transactions, including withdrawals. This ensures that sensitive data such as banking details, UPI IDs, or e-wallet credentials are encrypted during transmission, making it nearly impossible for unauthorized parties to access or intercept the information.

Account Verification (KYC)

The platform enforces a robust Know Your Customer (KYC) process to prevent fraudulent activities. Before withdrawals are processed, users are required to verify their identity by submitting valid documents such as a government-issued ID, proof of address, or bank account details. This process prevents unauthorized access to user accounts and ensures that funds are only withdrawn by the rightful account holder.

Secure Payment Gateways

Parimatch partners with trusted payment providers to facilitate withdrawals. Each transaction undergoes strict security checks to detect and block any suspicious activity. These payment gateways comply with global standards for online payments, adding an extra layer of security for Indian users.

Two-Factor Authentication (2FA)

For added protection, Parimatch allows users to enable Two-Factor Authentication (2FA) for their accounts. With 2FA, users must provide an additional verification code sent to their registered mobile number or email before initiating withdrawals. This significantly reduces the risk of account breaches, even if login credentials are compromised.

Fraud Detection and Monitoring

Parimatch employs advanced fraud detection tools that monitor user activity for unusual patterns, such as frequent withdrawal attempts or withdrawals to unverified accounts.

If suspicious activity is detected, the account is temporarily flagged, and withdrawals are paused until the user verifies their identity. This proactive measure minimizes the risk of unauthorized transactions.

Conclusion

Parimatch has established itself as a trusted platform for Indian users, offering a seamless and secure withdrawal experience tailored for mobile users. With a variety of convenient methods, clear policies, and seamless processes, withdrawing funds is straightforward for both new and experienced players. By following the outlined steps and adhering to Parimatch’s policies, users can enjoy quick and hassle-free withdrawals. Sign up to experience a platform that prioritizes your convenience, ensuring your winnings are always just a few taps away.

FAQs on Withdrawals at Parimatch

How long does it take to process a withdrawal on Parimatch?

Withdrawals typically take 24–48 hours, depending on the chosen method. E-wallets and UPI are faster, while bank transfers may take longer.

What is the minimum withdrawal amount?

The Parimatch minimum withdrawal limit amount varies by method but is generally around ₹300–₹500 for most payment options.

Are there any fees for withdrawing funds?

Parimatch does not charge fees for withdrawals, but your payment provider may apply transaction charges.

Why was my withdrawal request declined?

Common reasons include unverified accounts, incomplete KYC, or insufficient funds. Double-check all details before submitting.

Can I withdraw funds without completing KYC?

No, completing the KYC verification is mandatory for withdrawals to ensure compliance and security.

What withdrawal methods are best for Indian users?

UPI, Paytm, and e-wallets like Skrill or Neteller are preferred for their speed and convenience.

Can I use a method different from my deposit method for withdrawal?

In most cases, Parimatch requires the same method for deposits and withdrawals to prevent fraud.